Last Updated on March 11, 2024 by admin

Activity-flows and Internal Structures are the foundation of Management Accounting

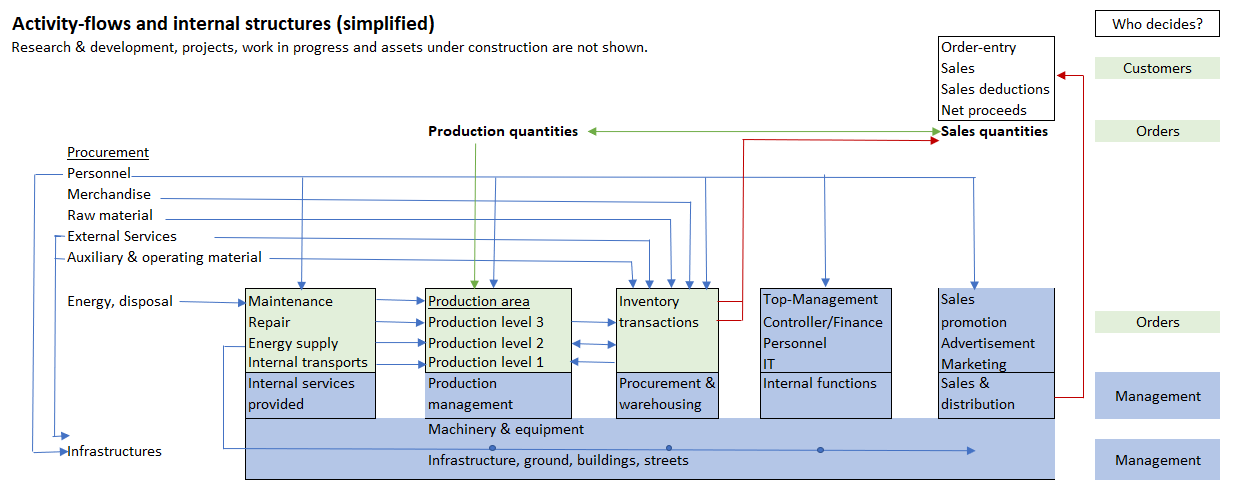

Managers decide on the dimension of structures to be built, such as buildings, facilities, machines, fleets and software applications. This leads to investment decisions and the investments subsequently lead to (imputed) depreciation costs.

Managers also determine which employees are to be recruited, exchanged or promoted and trained in their area of responsibility. This generates the personnel costs (including all social benefit costs, sick leave, vacations and public holidays).

Purchases of external services, licenses, energy are consumed in the functional areas or directly for the manufactured products and result in material costs.

Purchases of raw materials, merchandise and auxiliary and operating materials can be stored until they are consumed. As long as they are still there, no costs are incurred, only expenditures.

Contracts were entered into for all the items described, mostly by the purchasing department. The purchasing department or the ordering managers are therefore responsible for purchase prices and conditions (also applies to investments).

For the purpose of management support, purchases must therefore be clearly separated from consumption. Consumption mostly happens subsequent to purchasing and storing. The procurement of capital goods is also initially an expenditure and only leads to costs through depreciation of the installed assets.

Personnel expenditures are also not always incurred at the same time as the consumption of employee performance. Many employees receive a fixed monthly salary. They perform their work mainly in the long months with few public holidays and in periods in which only a few take holidays. A cost center manager therefore wants to know which personnel costs were consumed in a month so that he can compare them with the activity performed during this month. If, for example, a company closes down completely in July because of company holidays, no personnel costs are incurred for this month, although wage payments are higher than in other months because vacation allowance is paid out.

Each manager is responsible for QQDR (quantity, quality, deadline and result) (see “360° Management, section 1.2″). For this reason, both in planning and control, they must be able to compare the consumption of resources (valued as costs) with the services provided in the same period.

Most consumption is caused by the units produced or sold, not by management decisions. This includes, in particular, consumption of raw materials and semi-finished goods as well as personnel activities for production orders and directly activity-dependent costs of machines (e.g. energy). For management support and for the cause-related valuation of inventories it is necessary to charge these consumptions to the production orders executed (red fields).

In the sales/distribution area, a distinction must also be made between the services provided to initiate a sale and the costs of products and services consumed when a customer places an order. The former, summarized simply by the term marketing, must be planned and controlled by the respective sales managers. These can hardly be assigned to individual customers on a cause-and-effect basis. The latter are triggered by the actual sales order and can subsequently be clearly assigned to this order.

To enable the production and administrative areas to fulfill their tasks, they are supported by internal service departments. Examples include the workshop for maintenance and repairs, other workshops or laboratories, the group for internal transports, an internal energy center (electricity, steam, compressed air). The services these areas provide to the receiving cost centers can be measured (hours, kWh). In some cases they are directly dependent on the performance of the receiving area, e.g., energy consumed per machine hour. The recipients decide or agree with the internal service areas how much activities they want to receive. The receivers are therefore responsible for the quantity of services received and the service areas for the costs incurred in their area. This makes it possible to charge the proportional costs for consumed activities to the receivers in a way that is appropriate to the cause (costing internal services provided).

Internal tasks are performed in the administrative and sales-oriented areas. The services provided there differ from those of the internal service areas in several ways:

-

- They are necessary to coordinate the processes (management, planning, IT applications, databases).

- They ensure the timely and cost-effective availability of materials and external services (procurement)

- Legal requirements or internal rules are the cause of their execution (personnel administration, documentation requirements, audits, legal services)

- They prepare the actual sales and handle sales (marketing, sales organization, sales promotion, product management).

These internal tasks are never directly related in a cause-and-effect manner to the products or services produced and sold. Consequently, the costs of internal tasks must not be attributed to the products, as they are caused by management decisions (especially in the budgeting process, blue fields). A production manager, directly responsible for the execution of production orders according to the plan, will correctly say that he is not responsible for the internal tasks of other areas and for their respective costs.

Although many accounting regulations (international financial reporting standards and tax law requirements) require the allocation of structural costs (blue fields), accounting for management is designed in such a way that only the costs directly caused by the production orders are assigned to the latter (red fields). Consequently, only the product costs incurred by the products sold are to be charged to the sales achieved. Variances that occurred in upstream areas have no place in sales-related evaluations.

The customers of management accounting are primarily the managers. They want to be able to recognize from the internal evaluations whether the services provided in their areas were performed according to plan but taking into account the actual order quantities. Management accounting designed for management must therefore start from the activity flows and consistently charge costs only according to their cause.