Last Updated on March 11, 2024 by admin

Charging Internal Services

In many companies and in literature it is strongly believed that all costs of internal service areas should be charged to end products. This is done in order to be able to see how much a certain item did cost in total until it was received in the finished goods warehouse. The subject of this post is to show to what extent this approach can be implemented in a way that is appropriate for management and thus for decision-making.

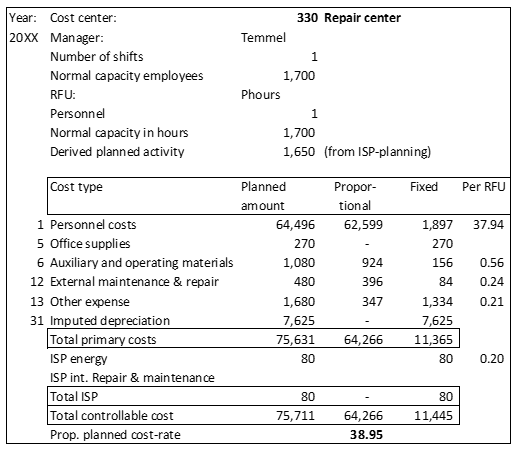

Our starting point is the plan of cost center 330 Maintenance and Repairs in the example company. Cost center manager Temmel is responsible for internal repair and maintenance work in the entire Ringbook Ltd. This also includes the operation of the energy center. Up to now, the manager was able to carry out this work alone. For larger orders, external service companies were commissioned. Their costs are planned in the receiving cost centers in the cost type “external maintenance/repairs”.

Based on the planning of the internal services provided the planned activity level of cost center 330 is 1,650 hours for the plan year. The question as to whether Mr. Temmel’s planned presence time of 1,700 hours will also be sufficient for his internal tasks was left open for the time being. If there will be some overtime it will be paid and shown as a cost center variance.

Together with his controller and his boss, Mr. Temmel prepared his cost planning on the basis of the planned activities. His own salary including social benefits amounts to 64,496. The consumption he has planned for his cost center is listed in cost types 5 – 13. Based on the equipment installed in his cost center, the controller has calculated the imputed depreciation of 7,625. From the previous measurements it can be deduced that the cost center will consume about 400 kWh of electrical energy per year. This corresponds to 80.00 at an internal rate of 0.20 / kWh.

The splitting of the costs into their proportional and fixed parts works automatically, as shown in our previous blog “Splitting Planned Costs into Proportional and Fixed”, when the plan data has been completely entered:

-

- His personnel costs are 64,496 for 1,700 hours presence time. Per hour this amounts to 37.94.

- He assumed that he will need 0.56 auxiliary and operating materials per hour of repair and maintenance work in his cost center. This amount is consumed with every hour worked for other cost centers and can therefore be integrated into the proportional cost rate. The remaining 156 of this cost type are incurred for the operational readiness of his repair center and can thus not be charged to the recipients.

- He proceeded accordingly when planning the other cost types.

This results in proportional planned costs of 64,266. Divided by the planned employment (1,650 hours), the proportional planned cost rate of 38.95 results.

The cost center manager is responsible for the planned fixed costs of 11,445. The installations and capacities of his workshop are there because they are planned by him and approved by his bosses in the budget. If he can dismantle them, for example by reducing the fixed maintenance of his own processing machines, the total costs of the job will be lower. However, the proportional cost rate for the service hour performed remains 38.95.

If any share of fixed costs for the workshop building, for the use of the canteen, for IT connection and personnel administration were allocated to the workshop cost center, the full cost rate of the workshop would explode but the proportional cost rate would remain the same. If the full cost rate were to rise to 100 EUR/hour as a result of these fixed cost allocations, the internal service receivers would get the idea of procuring the repair and maintenance activities externally, because they would be available there for 70-80 EUR per hour. This would not only result in more money flowing outwards. The fixed costs of the workshop would rise massively because less internal service would be provided, but the employee and the equipment would still be there. This would result in a reduction in profits for the company as a whole.

To avoid such undesirable developments, we recommend to only charge the proportional costs of internal services provided at planned cost rates. It is the management, not the receiver of the service, that decides on the amount of structural costs.

The idea of outsourcing internal services to a separate company within the corporation must also be carefully considered from an overall perspective. After all, the spun-off company must also build up and pay for all kinds of capacities. Investments must be written off, taxes and profit transfers to the parent company are due. This often led to the total costs of a spin-off getting higher than previous internal costs. This has then led to a higher internal price for the service than before.