Last Updated on March 11, 2024 by admin

Creating the standard cost calculation for an article requires the following data: bill of material and work plan, lot size, planned purchase prices for raw material, planned proportional cost rates of the cost centers.

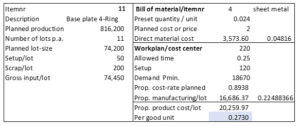

The base plate for the locking mechanism of a 4-ring binder is calculated as follows:

-

- From production planning it is known that the annual production of item number 11 should be 816,200 pieces. 11 equal lots of 74,200 units should be produced.

- The bill of materials shows that sheet metal for 50 units will be used for setup and that 200 of the manufactured units will have to be disposed as scrap. For one base plate 0.024 m2 of sheet metal are required.

- Together with the requirement for setup and scrap the requirement for steel amounts to (74,200 + 50+ 200) x 0.024 m2 = 1,786.8 m2.

- The planned purchase price per m2 is 2.00 EUR. This results in direct material costs of the lot of 3,573.60 EUR

- The work plan states that 0.25 machining minutes are required to produce one qualitatively good base plate (stockable). Added to this are 120 minutes for setup. The power requirement per batch is therefore (74,200 pieces at 0.25 min + 120 min setup = 18,670 min.

- These are multiplied by the proportional planned proportional cost rate of the stamping shop of 0.8938, which results in the proportional planned production costs of 16,686.37.

- In total, the proportional planned costs of this lot are EUR 20,259.97 or, for 74,200 good units, EUR 0.2730 per unit of inventory entry.

Valued at EUR 0.2730 / unit, the semi-finished product base plate 4-ring (itemnr. 11) is posted as a stock receipt. In the management-oriented system, this valuation approach for inventory movements applies to both planned and effective transactions. The reason for also using the planned proportional standard rates for real movements is that cost variances occur at the time of production and that the production managers are responsible for this variance. The orders that withdraw the semi-finished products for the next manufacturing level are not responsible for the variances that occurred previously and should therefore receive the products at standard cost rates.

For the same reason, the actual withdrawals of raw materials from inventory are always valued at planned purchase price. This is because if purchases are made at a higher or lower price than planned, a purchase price variance occurs in procurement. This variance can be observed by the purchasing manager and is shown in the overall result of a period. Often it is not possible to pass on purchase price variances to the production orders according to their cause, because it would then be necessary to decide which orders receive the same material at the lower and which at the higher price.

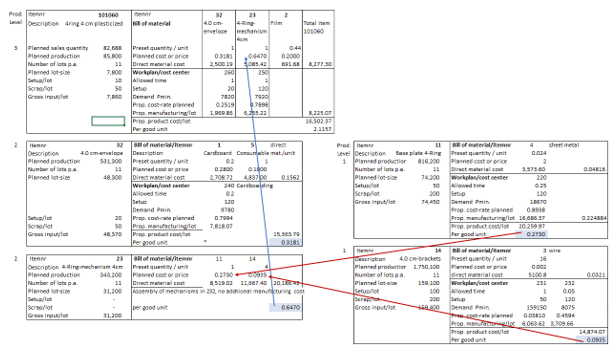

In our post “From the Sales Plan to Production and Purchase Planning” the multi-level bill of materials of item 101060 was presented. These steps from the raw materials to the various semi-finished products and to the finished product are shown in the standard cost calculation for the finished product 101060 below.

The proportional costs of every unit are always transferred to the next production level as standard values. Costs for setup and scrap are always included in the proportional standard costs. Although the warehouse receipts and issues are not shown, they are also always valued at these standard costs.