Last Updated on March 11, 2024 by admin

Project cost planning

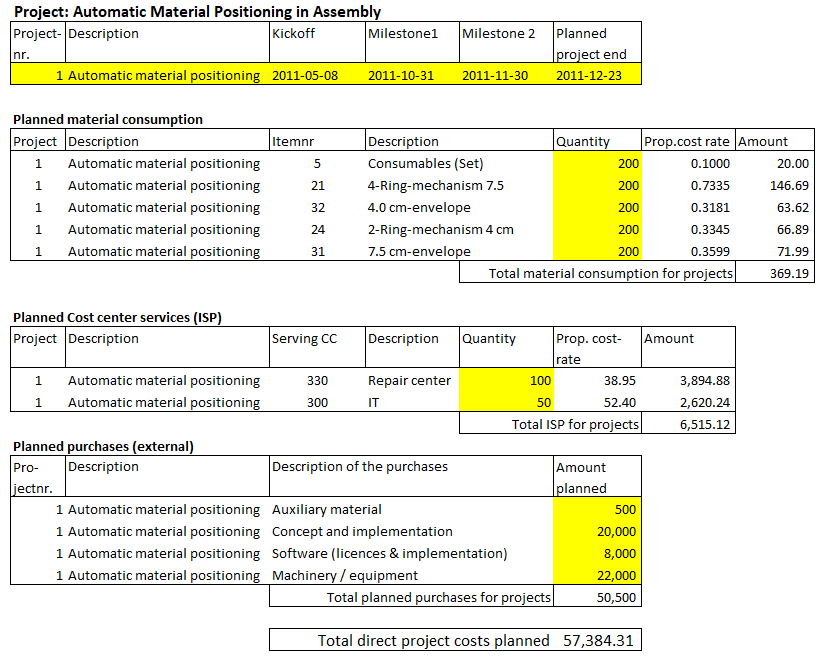

To release a project order its financial effects should be determined as well. Project cost planning requires a similar procedure as for product costing. As projects also generate costs and investments they also have to be represented in the management accounting system.

In the assembly cost center of the example company the material positioning (envelope and mechanism) should be automated with the help of a loading robot and at the same time enable an accurate positioning of the parts. Manager of this project is the head of the Assembly cost center. His employees will help set up the equipment and test it. An external company will be commissioned to handle the project, the in-house maintenance and repair center will ensure the availability of compressed air and electricity, and the in-house IT department will program and test the interfaces for the transmission of production order data.

The same procedure as for the manufacture of a product should therefore be provided for:

-

- Material consumption for testing

- Internal services of the cost centers Maintenance and Repairs and IT

- The time needed in the Assembly department to put the installation into operation (internal tasks)

- The external expenditures for the system (including installation) for testing (third-party invoices, cash out).

The project budget is created using the plan data from the simulation model (accompanying the book Management Control with Integrated Planning – Models and Implementation for Sustainable Coordination). The project budget serves as a basis for decision-making by the deciding managers when releasing the budget.

The internal services provided are already included in the post “Planning the Internal Services Provided”. These services, the investment, and the material consumption will be posted to the balance sheet as assets under construction. This is recommended from a management perspective, because the costs of the investment will not appear as (imputed) depreciation in the assembly cost center until the following periods. The points to be considered when determining depreciation in Management Accounting are discussed in another post.

Because projects will soon be omnipresent in companies, the working time requirements for internal tasks and for internal services provided in particular must be planned in detail. These hours have an increasing impact on personnel requirements planning.