Last Updated on March 11, 2024 by admin

After completing the planning for proportional product costs and net revenues (see the post From Planned Sales to Net Revenue), the data to calculate the contribution margins to cover structure costs is available.

Contribution Margins to Cover Structure Costs

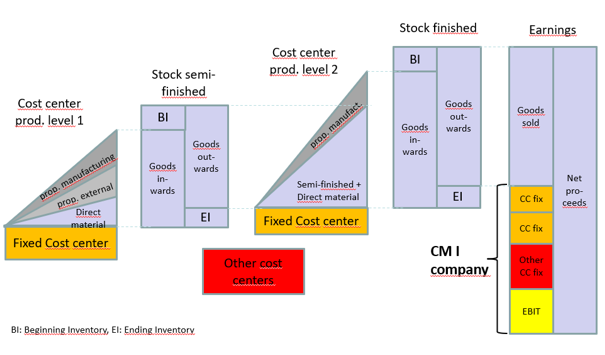

The proportional cost of goods manufactured includes those planned costs that are directly caused by the product (valued bills of material and work plans). All product costs are first booked as entries in the warehouse (semi-finished or finished products) at planned proportional costs (standard costs) and are withdrawn from there at the moment of delivery to the customer. The planned fixed costs remain in the cost centers.

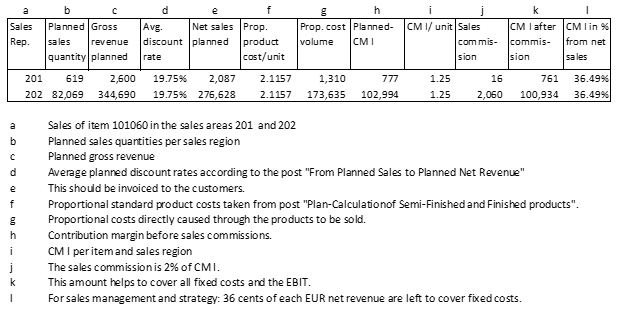

The example of item 101060 shows how contribution margin I is created in the plan:

Salespeople should not get a commission based on sales or net revenue as a component of their income. Doing so often leads to rebates of all kinds being granted in order to achieve the sales targets or to increase capacity utilization. Therefore, in the example company a contribution-based commission of 2% of the achieved CM I volume is credited.

The contribution margin I (CM I) is internationally defined as the difference between net revenue and proportional product costs (see Glossary). It is easy to see that the sum of all CM I must be sufficient to cover all fixed costs and earnings before interest and taxes (EBIT) if the result is to be in line with the objective. CM I is thus the contribution to structural cost coverage. The following illustration shows its creation:

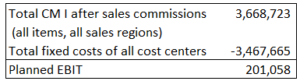

The following planned EBIT can be shown in the example company:

This illustration is not particularly informative. In the post “Multi-Level and Multi-Dimensional CM Accounting”, more detailed insights for the management are provided.

Cross-Industry Applicability

Before that, we consider the cross-industry applicability of this profitability analysis structure. So far, the example has been developed for a manufacturing company.

-

- In a pure trading company, the goods purchased are usually the goods sold. The company makes no changes to the product, that is, the bills of material and the work plans remain the same, so the purchase price corresponds to the proportional cost of goods manufactured. Small adjustments can happen if purchased goods are repackaged. All other costs are fixed costs since they are the result of the organizational and capacity structure of the trading company.

- In service companies, clear product definition is a prerequisite for the installation of an integrated planning and control system. Only the structured recording of the scope of services makes it possible to record the use of purchased services or products (bill of materials) and to describe the activities to be performed in the cost centers for a product in a measurable way (work plan). In an automotive workshop, the bill of material is of relatively great importance (spare parts, additional parts, externally commissioned paint shops). In a law office it is mainly the type of case to be processed (products) and the processing times required for this in the various departments (work plan) that are decisive, rather than the use of purchased parts or services.

- Public administration companies and, to a large extent, hospitals also know the consumption of purchased goods (parts list) and the work performed by their internal departments (work plans) for the planning and control of their cases.

- In banking institutions, the market interest rates of borrowed money define the proportional cost of the money lent in a mortgage while the work steps in the process of granting the mortgage loan correspond to the work plan and thus to the proportional manufacturing costs. The trading function comes to the fore when foreign currencies or gold (coins) are involved.

With the presentation of the planning of costs, services, and revenues as well as contribution margins for a manufacturing company, a more complex case was deliberately chosen. However, as the above references are intended to show, the presented system can be applied to almost all companies.

I like the helpful info you provide in your articles. I will bookmark your weblog and check again here frequently. I am quite sure I will learn a lot of new stuff right here! Good luck for the next!