Last Updated on March 11, 2024 by admin

Contribution Margin or Full Cost? What is decision-relevant?

Thanks to good negotiating of the CEO of Pekka Heating Systems Ltd., his company was able to acquire and realize a large installation order for a university building and a smaller conversion order for the heating system in a house with 6 apartments in the last period. Now the question is what kind of orders should be increasingly won in the future. A consultant was commissioned to calculate whether it would be more likely to win conversion orders or large installations of new systems. The consultant explained that, using the method he knew from school, he had first distributed the full manufacturing costs over the orders according to the number of hours worked. The costs of sales and administration were then allocated to the orders in proportion to the full manufacturing costs.

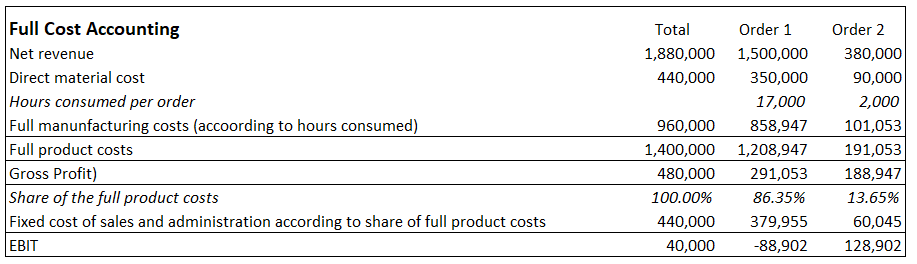

He presented the following calculation:

The verdict is clear: it is not advisable to accept large orders.

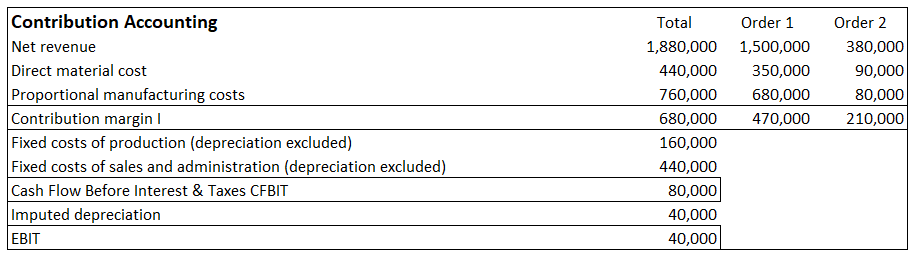

The project manager of the large installation project was, on the one hand, proud that Pekka Heating Systems Ltd. was able to successfully implement this large order and, on the other hand, frustrated by the massive loss of the order. Therefore he asked a friend if the consultants’ calculation was correct. The friend presented the following table:

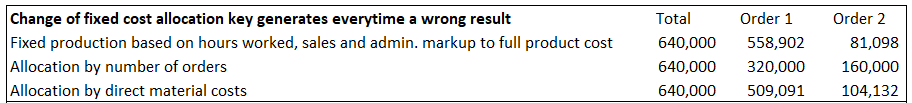

With the following example, the friend showed him that the application of different cost allocation bases (allocation keys) leads to different order results every time, despite the same initial situation. None of the results can be correct because costs are distributed that are incurred for the whole organization.

The conclusion remains that full cost accounting is not suitable for management control, because managers need to compare both in planning and in the concrete case of application the additional net proceeds of an additional order to the direct costs incurred with this order.

Precisely because various accounting standards and tax laws require the preparation of full cost accounting, management accounting requires the courage to not allocate fixed costs from one to other cost centers, orders, and products because otherwise managers will make wrong decisions.