Last Updated on March 11, 2024 by admin

Flexible Budget

When performing a target to actual comparison, cost center managers should be able to check monthly as to whether or not costs they can manage themselves are “under control”. Given that the annual plan is approved by the organization’s management who releases the cost center budgets, the budget must be adhered to. However, during the year various factors can deviate from the plan, including:

-

- Sales and production quantities,

- Purchase prices,

- Manufacturing processes efficiencies, and

- Employees retention rate.

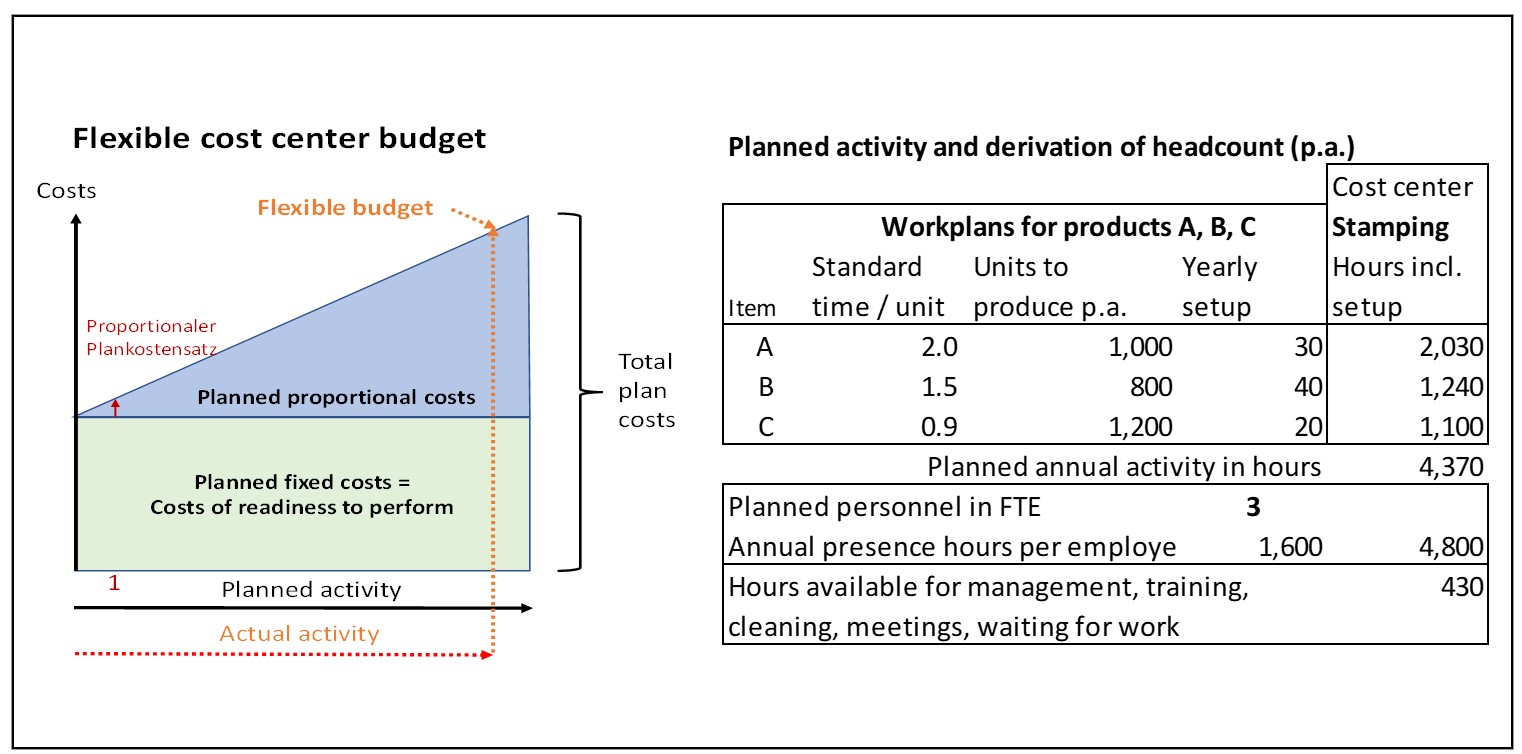

A simple comparison between planned and actual costs does not help cost center managers in their search for possible corrective measures because they lack a reference to the actual performance of the period under review. As a benchmark the flexible budget of the cost center should be calculated:

Flexible budget costs =

actual activity x proportional planned cost rate + planned fixed costs.

The flexible budget shows the planned cost of work actually performed in a period. If the activity performed in the period under review deviates from the planned activity, the proportional costs of the cost center will change, but the planned fixed costs should not. In the example below, actual employment is slightly less than planned employment. Therefore, the proportional plan costs is less than the annual plan, but the planned activity capacity (fixed) costs remain the same.

The flexible budget cost is thus the cause-related yardstick for assessing the total costs actually incurred by the cost center. If the cost center managers keep to their flexible budget, they will have achieved their cost target. If negative variances from the target costs occur, ways must be found to cumulatively reach the flexible budget again in the following months.

If cost centers perform activities that are not directly caused by a production order, a customer order, or by internal projects (e.g. research and development), they also have no planned or actual activity and consequently only fixed costs. In these cases, the flexible budget corresponds to the planned costs.

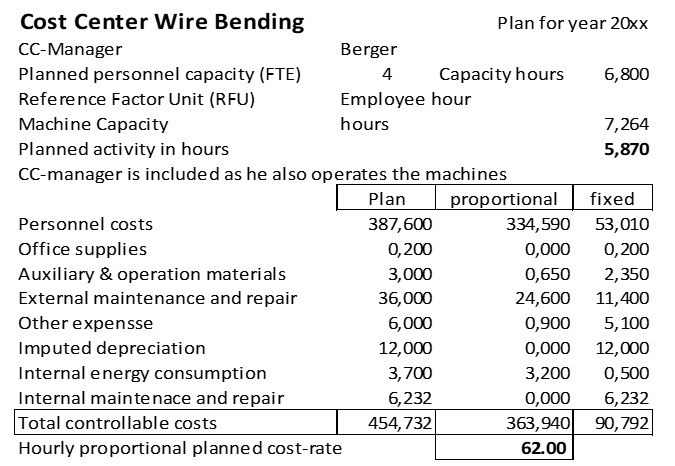

For the wire bending cost center in the example company the annual plan is as follows:

The installed capacity of the production equipment is 7,264 hours, which is sufficient for the planned production time.

The cost center has a planned workforce of 4 people who are planned to work a total of 6,800 net hours. This includes the working time of the cost center manager for planning and controlling the cost center.

The complete planned personnel costs of the cost center totals 387,600. The average hour worked (including the cost center manager) will thus cost 57.00 per hour (presence time).

According to production planning 5,870 employee hours will be necessary to execute the planned activity. This means that 5,870 hours at 57.00 per hour will “slip” into the products to be manufactured. This corresponds to 334,590 planned proportional personnel costs. The 53,010 difference between the planned personnel costs represents the costs for work not directly related to the products, i.e. the planned fixed personnel costs for the year.

In line with this, the other planned costs were divided into their proportional and fixed portions. Dividing the proportional budgeted cost of 363,940 by the planned activity of 5,870 hours yields a budgeted hourly proportional cost rate of 62.00 for wire bending. This rate is used to calculate the proportional costs of all products that will be processed in this cost center (see the post “Standard Cost Calculation of Products”).

If the activity of the issuing cost center is caused by a direct order of the receiving cost center or by its activity, there is a direct cause-and-effect link between the serving and the receiving centers. The planned proportional cost-rates can thus be charged to the receiving cost centers. The issuing cost center has its own planned and actual activity. The activities it performs for other cost centers can be measured. (Examples include repair and maintenance shop, laboratory, and energy cost centers). Thus, the respective cost center also has a proportional plan cost rate and its flexible budget is dependent on the activity performed for others during the period.

If the activities of a cost center are performed for the entire company, there is no direct cause-and-effect relationship between the producer of the activity and the users of the output. Therefore, the costs of such cost centers cannot be allocated to other cost centers according to their cause (e.g. reception, personnel administration, internal training, sales, production planning, finance, the majority of IT costs and top management). The IT costs for the ERP- or for the management accounting system are incurred for all cost center managers who use ERP data. The costs of generally used services cannot be charged to the users according to their origin (forced consumption). Due to this lack of causation, the allocation of fixed costs to other cost centers makes no sense. In other words, fixed costs should not be allocated to other cost centers, cost center managers should assume responsibility for their own flexible budget.

Flexible budgets are thus a prerequisite for the introduction of a Resource Consumption Accounting system RCA and for Contribution Accounting.