Last Updated on March 11, 2024 by admin

Decisions – Responsibility – Causality

CZSG Controller Zentrum St. Gallen/Switzerland introduced many decision-relevant planning and control systems mainly in German speaking countries. The basis was always “Grenzplankostenrechnung GPK” and the further developments arising from it. The applied management accounting principles correspond almost 100% to the recommendations for the design of “Resource Consumption Accounting RCA” according to Larry R. White (Journal of Corporate Accounting & Finance, Volume 20, Issue 4) and of the Profitability Analytics Center of Excellence PACE.

Who decides what?

Many chief financial officers and cost accountants see the purpose of management accounting primarily as presenting an organization’s financial results in accordance with the requirements of local accounting laws, IFRS and USGAAP, local tax laws and regulations for setting transfer prices between related companies, and other regulations.

In our eyes the purpose of management accounting is first and foremost to provide decision support for managers at all hierarchical levels. After all, they are responsible for the results to their superiors. The focus is on management support, not on external reporting.

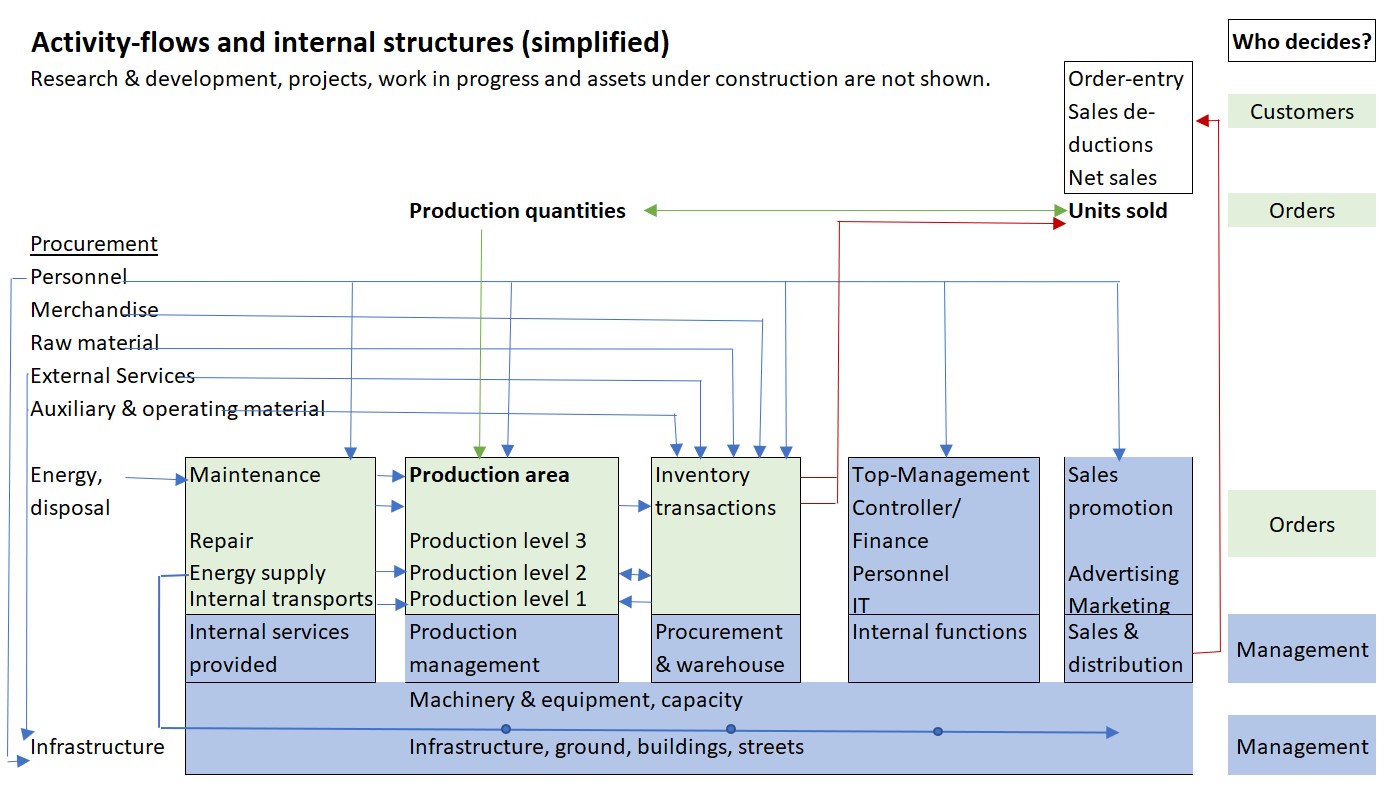

Customers decide whether they want to place an order and at what price. In this way, they also indirectly decide the proportional costs of the products or services to be sold and manufactured. Managers at all levels decide how the necessary offers are to be made and what personnel and machine capacities will be required to process the orders won and, in doing so, to achieve a profit with the company in line with the complete market.

In strategic and operational planning, managers at all levels must define activities, quantities and capacities. Consequently, consumption according to bills of materials and work plans as well as activity-based cost center budgets are required for planning and subsequent control. Only when these quantities and activities are known can they be valued in monetary terms. A management accounting system that is suitable for decision-making must therefore provide those quantities, activities and valuations which a responsible manager can control himself and thus take responsibility for. This also requires that the manager can always compare the planned values with the actual values of his area.

This starting position applies to manufacturing companies, service providers, hospitals, retailers as well as banks and government institutions.

No financial accounting system can provide this data, as it only represents values. Valuation regulations from tax law, from accounting standards (US GAAP, IFRS) or from specifications for the determination of international transfer prices are also irrelevant in accounting for management, because cost center managers, product managers and salespersons cannot change these values themselves.

Responsibilities of different managers

Since managers are responsible for achieving their objectives, it is recommended to list their responsibilities.

Production manager:

-

- Timely processing of dispatched production orders

- Ensuring stock receipts of semi-finished and finished products (valued at proportional standard production costs)

- Adherence to target consumption rates for materials and cost center activities in accordance with the pre-calculation of released production orders, valuation of consumption at planned purchase prices and proportional planned cost rates

- Compliance with the planned costs of its own cost center(s)

- Notify other areas when capacity constraints become apparent.

Cost Center Manager:

-

- On-time completion of manufactured work

- Adherence to the pre-calculated times in the production orders to be processed

- Adherence to target costs (flexible budget) of own cost center, taking into account pre-calculated times and work performed.

Sales Manager:

-

- Achievement of planned net revenues per period (invoiced).

- Compliance with the planned costs of his own cost center(s)

- Meeting the agreed delivery dates to the customers.

Purchasing Manager:

-

- Procurement and on-time availability of all goods and services to be purchased.

- Determination of planned prices (standard prices) for raw and auxiliary materials as well as services to be purchased (on this basis the standard cost calculations are prepared)

- Informing sales and production in the event of major variances between actual and planned cost prices.

Who is responsible for depreciation?

-

- The manager in whose cost center the asset is located,

- the managers who determined the planned useful life of an asset on the occasion of the investment decision,

- the financial manager or the controller who determines the depreciation method (preferably fixed depreciation from the replacement value of an equally efficient asset)

- Depreciation is mainly a period cost, since most assets do not need to be replaced because they no longer function, but because they are technologically obsolete.

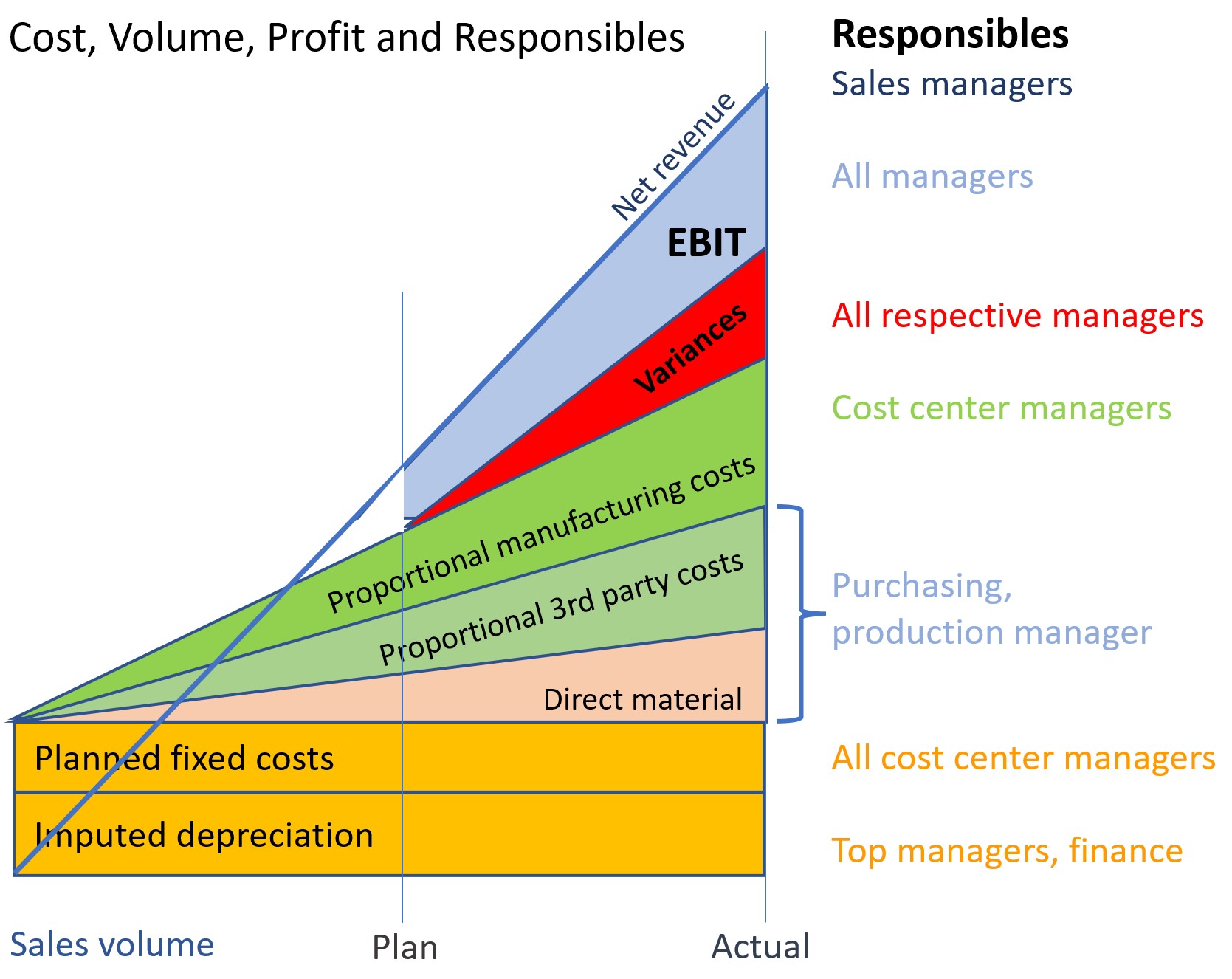

In the stratified presentation of the origin of results and profit, the contribution of the individual responsibles and their employees becomes apparent:

Who is responsible for idle capacity?

-

- The managers who bought too large a plant,

- the salespeople who sold too little

- possibly cost center managers, if they do not point out idle capacity to their colleagues.

From this it can be deduced that it makes little sense to allocate costs of idle capacity (especially personnel and depreciation costs) to cost centers or product groups. As mentioned, imputed depreciation and personnel costs are charged to cost centers because they are observed there.

Strong and weak causalities

In our opinion, a strong causality is given if the consumption of an input good, e.g. the output of a cost center or an employee, is directly caused by the storable or saleable product. This is the case if a routing or/and a bill of materials can be created for the product or the service unit performed. In Grenzplankostenrechnung GPK, therefore, only proportional costs are charged to products or services, and the remaining fixed costs are transferred to stepwise contribution accounting. This is because fixed costs can only be changed by management decisions, such as firing an employee or purchasing a machine.

Weak causalities do not show a direct dependency between output and input.

Example 1: Because the headcount has increased, the HR department needs an additional employee for everyday personnel support. There is no rule how many employees one person in the personnel department can supervise. It is a management decision whether to hire the person or not. The costs directly attributable to a manufactured product do not change as a result of the increase in staffing levels, since no changes are required in either the bills of materials or the routings. But the fixed costs of the company increase.

Example 2: A company fills gas cylinders and delivers them to customers by trucks (see the case study “Le Petomane Gas in the PACE homepage“). Delivering to a remote customer requires an additional hour of travel time, resulting in corresponding fuel and labor costs. These could be saved if the customer is no longer served. On the other hand, the net sales minus the proportional costs for the delivered gas cylinders, i.e. the contribution margins I of this customer would be eliminated. This results in: + omitted transport costs – omitted contribution margins.

The proportional product costs per filled gas cylinder in the finished goods warehouse can be clearly determined since material consumption and work schedule for filling are defined in the technical bases (strong causality).

Example 3: Most companies have a central IT cost center for the implementation, operation and maintenance of applications and data. The resulting data and evaluations are used (to varying degrees) by many cost centers. In cost accounting, therefore, a search is often made for cause-effect chains by means of which the IT costs can be charged to the receiving cost centers. Mostly this search is unsuccessful because both the data sets and the applications are used by a wide variety of cost centers (very weak causality).

Nevertheless, many financial managers and cost accountants try to allocate the fixed costs of the IT department (including depreciation) to the various cost centers and from there to the manufactured products by means of one or more allocation keys. After all, according to the widespread opinion that each product must bear its share of the total fixed costs. However, the IT manager plans and controls the costs of the IT department and is consequently also responsible for them to the management. There is no need to allocate costs to individual cost centers and products. The contribution margin from sales must be sufficient to cover all fixed costs plus the target profit.

Insight:

In Grenzplankostenrechnung GPK, only proportional costs are allocated to manufactured products because they were directly caused by the products (only strong causalities). Therefore, in management-oriented cost and revenue accounting, inventories should also be valued only at proportional (standard proportional product costs). This is because fixed costs are period costs and, as such, should be shown as blocks in the contribution margin accounting. They are to be controlled in the cost centers.

Precisely: In GPK and in Resource Consumption Accounting RCA, fixed cost allocations have no place because these allocations are an attempt to delegate cost responsibility to units that have no direct possibility of influencing the costs at the point of origin.

Of course, it makes sense to include fixed costs in pricing for individual customers. However, in our view, this is activity-based pricing, not costing. Therefore, considerations about setting offer prices and conditions should be made outside the management accounting system, especially in the sales organization.

If in the Costing Levels Continuum Maturity Model from Gary Cokins the levels 11 and 12 are to be reached, all allocations of fixed costs must be eliminated, because otherwise no useful simulations are possible. IFAC-Evaluating-the-Costing-Journey_0.pdf