Last Updated on March 11, 2024 by admin

Management Accounting is a Prerequisite for Financial Accounting

Many companies base their choice of software modules to be used for ERP and accounting on legal requirements. Financial accounting must be kept because profit or loss as well as assets and liabilities must be reported at least once a year. At the same time, accounting regulations must be complied with (local commercial and tax law, internal settlements between companies of a group).

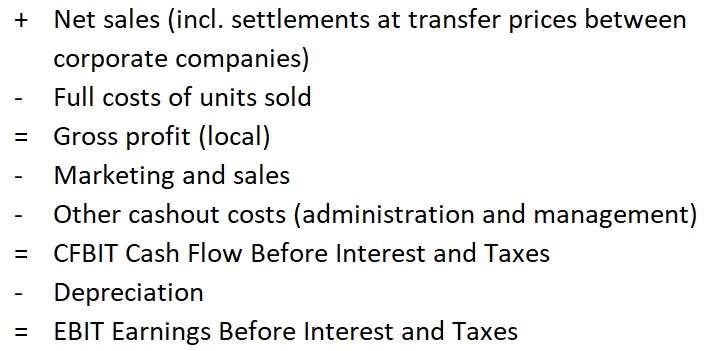

In addition, the rules of the international accounting standards (IFRS, US GAAP and the like) mostly assume the following basic structure of the income statement:

Full cost structure of the profit and loss account

This is the usual form of the profit and loss account presented externally and very often internally. It can be created with auxiliary calculations from financial accounting. All consumptions incurred in a period for the plant (material, personnel, external services, depreciation and even pro rata interest costs) are debited to the plant cost center (simplified all costs incurred within the fence of the plant). This results in the full cost of goods sold after accrual of inventory changes. Similarly, all marketing and sales costs are concentrated in the collective cost center for marketing and sales. Also, the costs for administration and management and possibly for research and development are added as a percentage of the full costs of products sold. This presentation mostly meets the requirements of the mentioned external standards of financial accounting.

However, the executives of a company, especially the product and cost center managers plan and decide quantities, activities and prices and create new products and services by means of input factors such as working time, material or energy. Corporate management expects all managers of lower levels to take responsibility for the costs of their area. To this end, it must be ensured that there is a causation-based relationship between costs and the units created and sold.

Cost, performance, revenue and profitability accounting

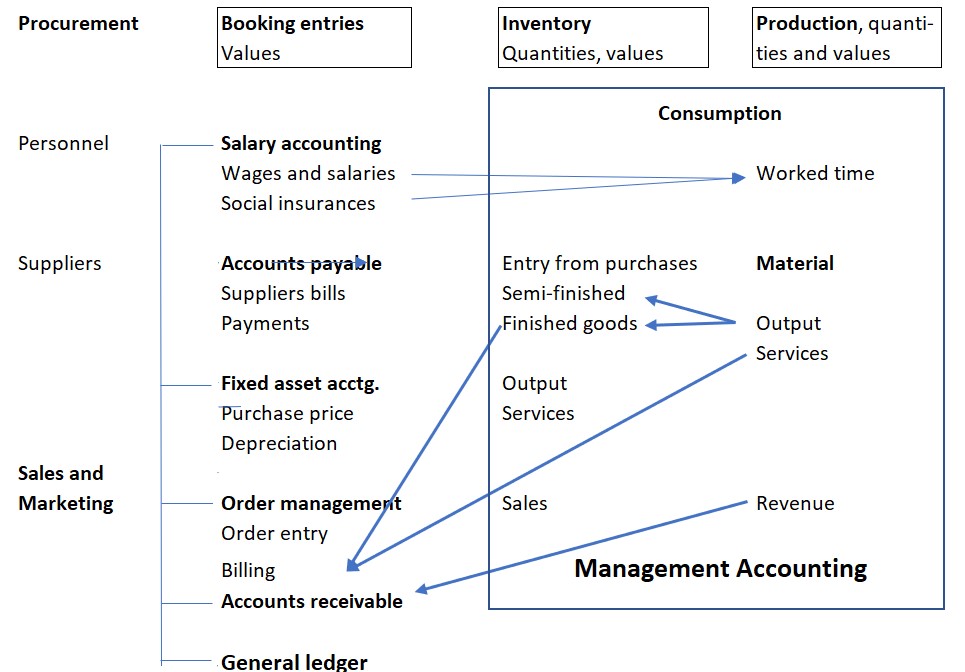

The relationship to quantities, consumption and values can only be established in a management accounting that presents cost, activity, revenue and earnings. This system calculates how much the consumed quantities and services did or should have cost per product or service unit. Accounting for management is a matter of calculating the plan, target and actual of the units produced and sold. Because both the cost and the revenue side are included, the term management accounting became established.

The figure below shows that in the various auxiliary accounts and in the summarizing general ledger accounting, the focus is on the period view for the company. In the right-hand management accounting section, on the other hand, the order or unit view is decisive. Managers at all levels want to know how much it cost to manufacture a product or service unit in their management area. In order to calculate the result for the period, it must also be known by how much the inventory quantities of raw materials, semi-finished and finished products have changed per item. Costing per product unit is a prerequisite for this valuation.

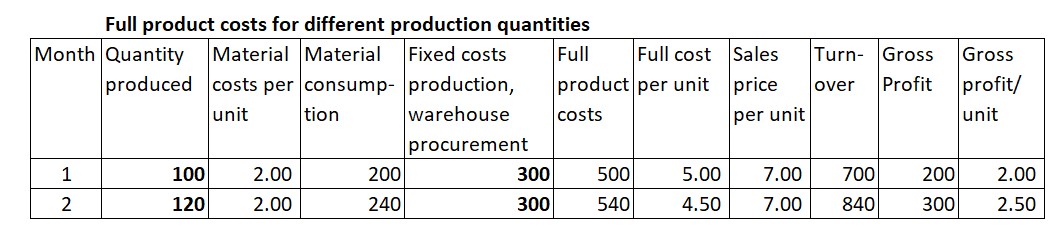

In the accounting-based full cost structure of profitability analysis, both unit and period costs are deducted from net revenues to arrive at Gross Profit. Example:

In month 1,100 pieces were produced and sold. This resulted in full production costs of 500, taking into account the cost center costs of production,warehousing and purchasing. In month 2, 120 pieces were produced and sold at the same material purchase price of 2.00 per piece. According to accounting, the personnel costs remained at 300 (the existing employees had enough capacity for the additional production). As a result, the full manufacturing cost per piece dropped from 5.00 to 4.50.

Questions:

-

- Is the finished goods inventory receipt to be posted at a different valuation each month (moving average)?

- If yes, does the gross profit per unit change each month because the capacity utilization is different? What is the correct valuation approach for planning and managing sales?

- The differing full costs of goods sold per unit are the result of the utilization of the production cost centers. The staffing and machinery of these cost centers is determined by production managers, not by sales.

Planned and actual costing are core functions of management accounting.

The calculated values are not only used for inventory valuation but above all are compared with the net revenues generated by sales. As the sales organization is not responsible for variances in production and procurement this requires that direct material consumption is valued at planned purchase prices and work plan positions are valued at the planned proportional cost rates of the cost centers. Splitting cost center costs into their proportional part (driven by the products) and their fixed part (driven by the dimensions of the cost centers) is a key requirement for decision-relevance.

Controllers and management accountants must therefore set up their system in such a way that a distinction can already be made in the standard cost estimate between proportional costs directly caused by the products manufactured and fixed costs that are mainly the result of management decisions. This is because the net revenue from a sale to a customer must first be compared with those costs that can be allocated to this order in a manner that reflects their cause. In the absence of a direct cause-and-effect relationship, fixed costs can only be allocated to a product or a customer by applying allocation keys that are arbitrarily chosen by the majority. Only small proportions of marketing and selling costs and other cash out costs can be allocated to an individual product or customer on the basis of causation.

In Accounting for Management rules such as IFRS, US GAAP or tax laws do not apply. They lead to incorrect decisions.

Example: A product with a high proportion of material or external activity costs must bear a higher proportion of the fixed costs of purchasing and the warehouse cost centers, even if its procurement is uncomplicated and can be handled with a telephone call or an e-mail. This increases the full manufacturing costs of this product, with the result that the markups for marketing and sales costs and for other cash costs and depreciation also increase. This is because such surcharges are calculated on the basis of the full manufacturing costs. The product then no longer looks particularly worthy of promotion because it is “broken” by surcharges.

Conclusion: A management accounting system is built to support all managers of a company in their decision-making so that they can achieve an overall improvement in the company’s results. Fixed cost allocation does not help in this optimization process. According to the current state of knowledge, it is recommended to set up management accounting as marginal costing, combined with multi-level contribution margin accounting .

The Institute for Management Accounting IMA still trains and propagates the “full cost structure of profit and loss accounting”. The focus is still on external reporting, not on internal decision making. These non-decision-making guidelines led to the establishment of the Profitability Analytics Center of Excellence (PACE). Find practical examples and technical papers on how management accounting can increasingly fulfill its mandate to show executives ways to improve results on their homepage.