Last Updated on August 28, 2024 by admin

Cost price is irrelevant for decision-making

Cost price is the total cost of a company in a period, adjusted for changes in inventory. According to Wikipedia.org, this includes material costs, manufacturing costs, research and development costs, administrative costs and distribution costs. as well as imputed interest for assets required for operations (see German Guidelines for Price Determination on the Basis of Cost of Goods Sold (Annex to Regulation PR No. 30/53 of November 21, 1953, Notes 43 – 45)). If the net revenues exceed the cost price, the company starts to make a profit.

This statement is true for the company as a whole but it misleads when it comes to management control. Who wants to calculate the cost price of an article, a customer or a subdivision of the company, has to break down the fixed costs to product units. But as there is no direct cause-and-effect relationship between the company’s fixed costs and the individual product unit sold, this can never be done properly

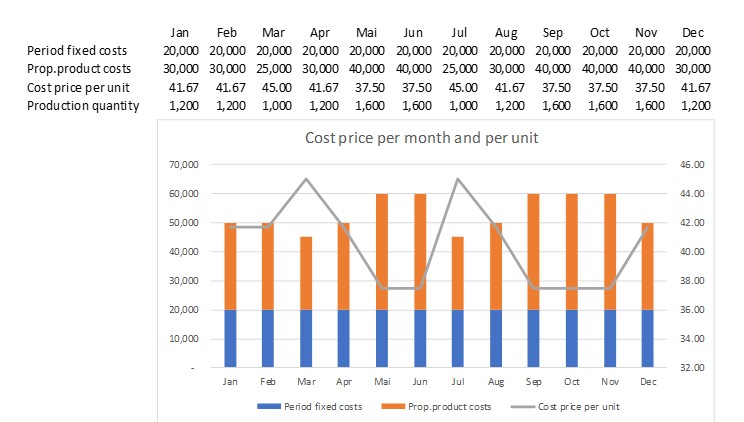

To calculate the profit contribution of an item, the cost price per unit of a product or service unit sold must be calculated. All fixed period costs must therefore be allocated to the product units sold. For this purpose, an overhead rate is determined for the calculation of the unit cost of goods sold. If the sales quantities or the fixed cost blocks change, the cost price per unit unit also changes. This affects inventory valuation and, even more important, the management of sales and production.

As long as neither the bill of materials nor the routing and neither the material purchase prices nor the proportional planned cost rates of the cost centers involved in production change, the proportional costs incurred per unit produced remain the same. However, distributing the fixed costs to a different production or sales quantity, results in different cost prices per unit. Neither production nor sales are responsible for this, only the capacity utilization.

In the example, the monthly cost price per unit of goods sold changes because the fixed costs are divided by the production quantity of the period under review. If inventory receipts and issues are valued monthly at full productions costs, they include a portion of the period’s fixed costs. The value per unit thus changes every month. The fixed costs of other functional areas of a company are usually added as percentages to the full production costs. Although cost of goods sold is necessary in external reporting, it is not useful for corporate management purposes:

-

- If the really paid purchase prices deviate from the planned ones, first the purchasing department is responsible for the variances.

- If in the production processes more direct material is consumed per unit produced than planned (or more semi-finished products), the production management is responsible.

- If the standard times for the manufactured product units are not adhered to in the production cost centers, it is up to the respective cost center managers to take corrective action.

The data required for this can only be obtained if the splitting into proportional and fixed costs has been set up in the management accounting system. This can be achieved with marginal costing (flexible standard costing), see the posts “Full product costs are always wrong” and “Complete variance analysis“).

Since the demand, respectively the customers and the ability of one’s own sales organization determine the net revenues, it is necessary to compare the latter with the proportional product costs of the services and products sold. Our experience shows that most companies sell their items at different contribution margins per unit. The sum of all contribution margins achieved must be sufficient to cover all fixed costs and the targeted profit. An item that does not cover its calculated cost price can still make a considerable contribution to covering fixed costs.

The aim is always to cover all fixed costs and all variances with the contribution margins from the units sold, while at the same time achieving a profit in line with the market.