Last Updated on March 11, 2024 by admin

Cost plan for the IT-Cost Center

The company’s IT department is responsible for the installation, operation and further development of all applications used throughout the company. In the example company these are: ERP (production planning and control, purchasing and inventories, projects), PLM (product life cycle management), CMS (customer acquisition and support, quotation preparation and tracking, sales orders, analyses), payroll administration, financial and management accounting, internal and external communication (mail, internet presence).

In most cases, several functional areas of a company use these applications. They collect data, analyze content and create evaluations.

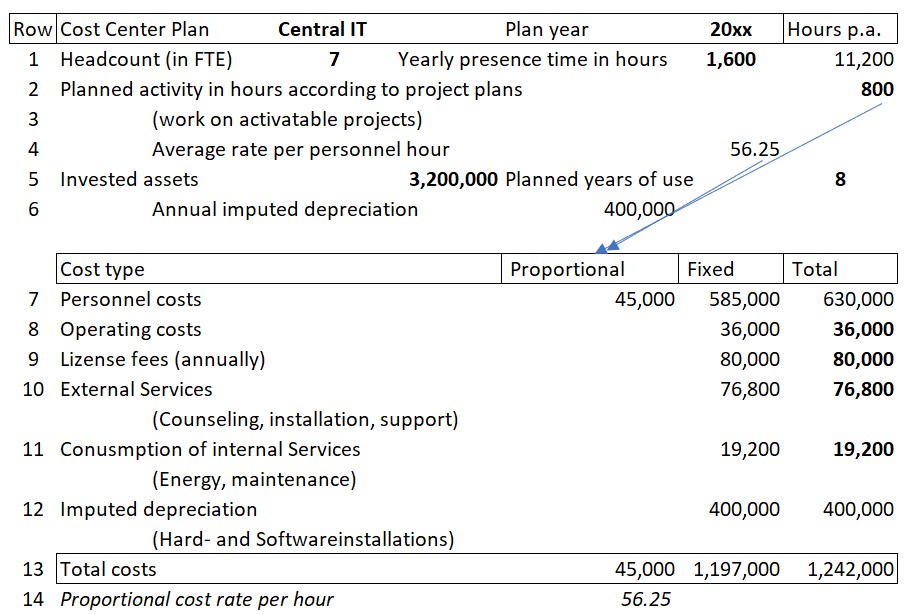

The IT department is responsible for the operation, extension and maintenance of the existing applications as well as for the necessary hardware and communication installations. It is also planned that its employees will work 800 hours in the planning year on development projects that can be capitalized and amortized in subsequent years.

For this purpose 7 employees (full-time positions FTE) are employed: (1 IT manager, 4 persons to operate the applications, create evaluations and maintain the hardware and software installations, 2 persons to further develop the applications and work on (capitalizable) projects.

The following cost center plan was defined for the planning year:

Notes:

If the plan is approved as presented, the head of IT is responsible for adhering to the planned costs of 1,242,000 (line 13).

If IT department services were directly dependent on the actual performance of the receiving cost centers, they would have to be charged to the receiving areas at proportional costs. However, there is rarely a direct cause/effect relationship between the recipient’s activities and those of the IT department.

If the costs of further IT developments are to be capitalized, i.e. written to fixed assets, the proportional personnel costs (45,000, line 13) are included because these directly performance-related costs are causally necessary for the creation of fixed assets. All other cost types of the IT cost center are not directly caused by the IT services purchased. They are period costs.

The calculation of imputed annual depreciation in accordance with lines 5 and 12 depends mainly on the valuation rules applied in the respective company (what is capitalized and what is charged directly to the annual financial statements?)

The IT cost center performs various internal tasks. The costs incurred for these are to be planned and accounted for in this cost center.

Conclusion:

Cost planning and the control of internal tasks take place in the cost centers that perform them, because this is where the personnel and systems work, but their costs can rarely be clearly assigned to an individual internal task.

Internal tasks generate period-related fixed costs. This is because their amount is only indirectly dependent on the services produced or sold. Consequently, the costs of internal tasks cannot be charged to the cost centers consuming them or even to the units produced. They are the result of the company’s willingness to perform and the associated management decisions.

Internal tasks can rarely be measured in units, as they usually comprise a bundle of tasks and are not directly related to sales or production quantities.

The costs of an Internal task can usually only be estimated as often several cost centers contribute to an Internal task. However, it is important to continuously record the working time consumption per Internal task. This is because personnel costs carry the most weight and cause the readiness to perform costs to swell.

The costs of all Internal tasks must be covered by the contribution margins.