Calculating imputed depreciation

Entrepreneurs want to know what existing and additional investments will be required to generate the planned profit (EBIT) in the coming years. The amounts originally paid for the fixed assets are only partially relevant for this because inflation and technological developments often lead to higher replacement values and therefore higher imputed depreciation. If the replacement value of an asset increases by 20% compared to the previous year, the imputed depreciation for this asset must also be increased by 20%. This reduces the (distributable) profit, but also ensures that the money remains in the company to finance replacement investments.

The annual business plan must therefore determine which and how much fixed assets will be required in the planning year in order to achieve the planned profit. For this purpose, it is necessary to estimate by how much the replacement value of an existing and still used asset will increase in the year to plan. The replacement value is divided by the useful life planned by management and results in the imputed depreciation of the asset in the year to plan.

By stipulating that the imputed depreciation is charged to the income statement each year, the owners ensure that the money for replacement or renewal investments remains in the company’s current assets or is used to reduce interest-bearing loans. The funds for maintaining the company’s ability to perform are thus available because less has been distributed to the owners or been given away through lower sales prices. External cash inflow for the further expansion of the company is only necessary to finance growth.

Replacement value and imputed depreciation

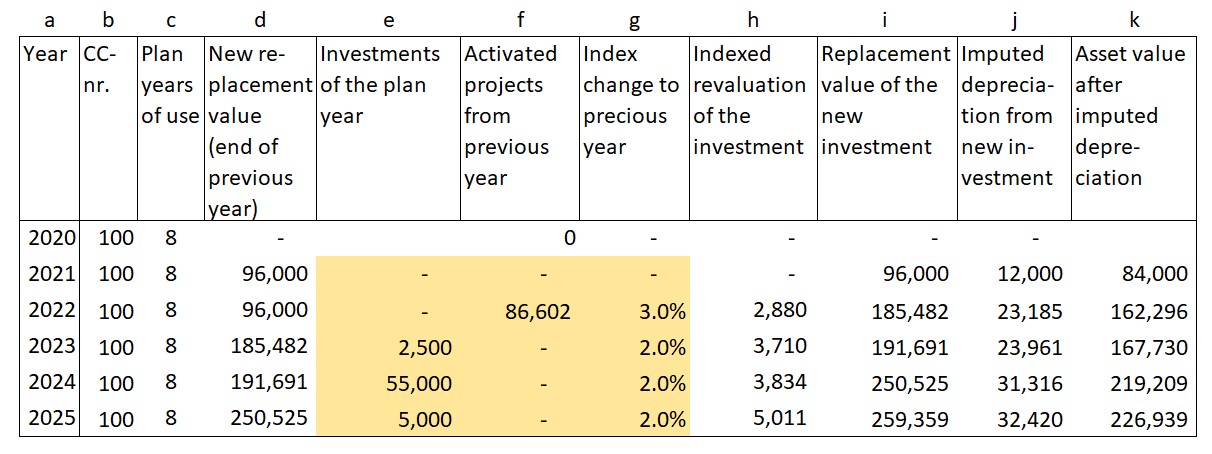

Using the example of cost center 100 (sales management) at Ringbook Ltd., the following steps are required to determine the replacement value and the imputed depreciation:

-

- The fixed assets of cost center 100 amounted to EUR 96,000 at the end of 2020.

- The management of Ringbook Ltd has determined that machines, equipment and software can be used for 8 years until they need to be replaced. This results in a depreciation of 12.5% of the acquisition or replacement value (EUR 12,000, column j) for 2021.

- The replacement value therefore amounts to EUR 84,000 at the end of 2021.

- In 2022, an online store was set up for cost center 100. Project costs of 86,602 (column f) were incurred for this. These were capitalized so that the replacement value of the fixed assets in cost center 100 amounted to EUR 182,602 at the end of 2022.

- In addition, a general inflation rate of 3% (inflation rate, column g) had to be taken into account in 2022. This had an impact on the replacement value of the original investment of EUR 96,000 at the beginning of 2022 (EUR 2,880, column h).

- In total, 12.5% of the replacement value of 185,482 (column i), i.e. 23,185 (column j), was to be charged as imputed depreciation for 2022.

- In the years 2023 – 2025, the new investments (column e) are added to the existing assets of the cost center. They must also be taken into account in subsequent years.

- The effects of the annual inflation rates (column g) increase the replacement value of the existing investments in cost center 100. Depreciation of cost center 100 also increases (column j) and thus also the balance sheet value to be reported in the internal reporting at the end of the year (column k).

Estimating the replacement values of existing investments is often difficult, as quotations have to be obtained from potential suppliers. For this reason, many companies use the index method to calculate the replacement value of an asset. The question is how much an acquisition will increase in the planning year if it is multiplied by the current inflation rate (columns g and h).

Imputed depreciation is a cost type of cost center costs because the operating resources (assets) are assigned to cost centers and are used in these cost centers to produce services. For large assets that are used by several cost centers often a separate cost center is set up. An example is a factory building in which various cost centers are housed.