Management Accounting for Different Types of Companies

Private companies, many foundations and associations as well as public organizations and their administrative units manufacture products and services. All these organizations must be able to cover at least the costs of a period under review with the revenue of this period (year) and, where appropriate, to achieve a profit in line with the market. (See the post “Profit in Line with the Market“).

Consumption-related disbursements usually happen before customers pay. Therefore, it must be ensured that sufficient cash and cash equivalents or open credit lines are available at all times to pay the amounts due. For this, financial accounting is the appropriate instrument in all organizations. However, financial accounting is not suitable for planning and controlling an organization as it cannot process neither quantities nor services and relate their costs to the revenues according to cause.

Management accounting is the only way to charge costs and services to individual service and product units in line with causation. It calculates the planned and actual costs directly caused by the manufacturing of a product or service unit and deducts them from the net revenue generated. The result is the contribution margin I. This is used to cover all costs of the organization that are not directly product-related (fixed costs) and to achieve a profit in line with the market.

For decision-relevant management accounting this results in the requirement to split costs into proportional and fixed when planning cost centers and to charge only the proportional costs of the manufactured units to products or other cost centers. This is because there is only a direct cause/effect relationship for the proportional cost center costs. The fixed costs remaining in the cost centers are period costs. They are the responsibility of the cost center managers. They are transferred as cost blocks to the stepwise contribution accounting.

According to current knowledge, only Resource Consumption Accounting (RCA, see L. White, Resource Consumption Accounting) fulfills this requirement. In German-speaking countries, Grenzplankostenrechnung GPK combined with contribution accounting correspond to RCA. RCA shows which costs are caused directly by the manufacture of the individual product unit produced. These costs are to be recorded per unit as inventory receipts and can be charged to the units sold according to their origin. The costs not incurred directly per unit remain in the cost centers. They are to be understood as fixed costs for the period under review. They are fixed costs because they are incurred for the cost center’s readiness to perform.

How to plan cost center costs and to calculate proportional cost rates for product costing is a main topic of this blog. The application of the methodology in different kinds of companies as well as in corporations with many daughter companies or in public administration are discussed in more detail in the following posts. The focus is on:

-

- Production and sale of physical products, e.g. industrial and construction companies

- Pure trading companies

- Service companies, e.g. consulting companies, auditors, law firms, software developers

- Transportation companies

- Banks and insurance companies

- Healthcare facilities such as hospitals, retirement homes, laboratories

- Public administrations and educational institutions.

What these types of companies have in common is that they

-

- work for several customers,

- can process several orders for a particular customer, each with several order items,

- offer different products or services,

- can divide their organization into cost centers, each of which is the responsibility of one manager,

- should charge activities between cost centers according to their origin (Charging Internal Services, no allocation of fixed costs),

- want to know which customers, products and services generate how much contribution margin.

For the planning and analysis of results by the managers concerned, the contribution margin I per product and per customer is always relevant for decision-making in the various types of companies. Because the fixed costs cannot be allocated to an individual order item according to their origin, the evaluations must always be based on CM I per order item.

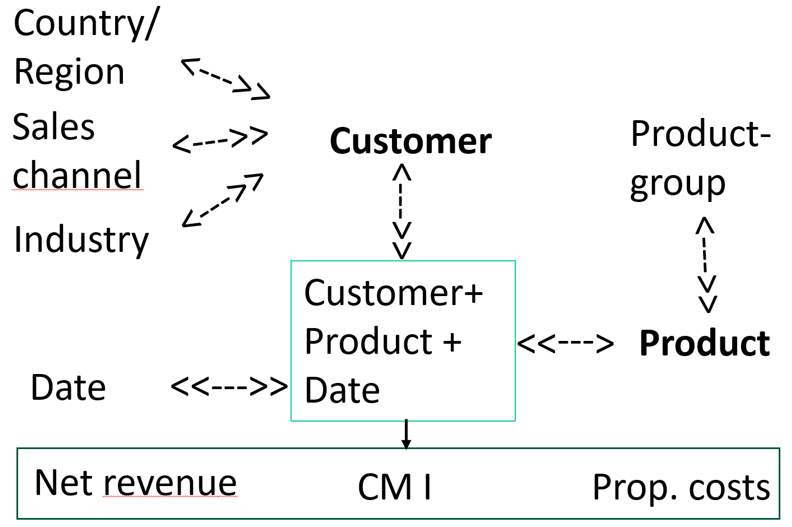

The following data model shows that for aggregated reports always 1:n relationships (1 < —>> n) are needed:

Reading method: On a specific date, a customer can purchase one or more products or services. The proportional product costs are defined per unit, customer and date, the CM I is the difference between the net revenue agreed with the customer and the proportional cost. Based on the customer, the product and the date, net revenue, proportional product costs and CM I can be summarized according to all higher-level dimensions.