Management Accounting or Bookkeeping?

A chief financial officer (CFO) has the task to maintain the company’s solvency at all times and to value and publish the items in the income statement and in the balance sheet in accordance with the applicable legal and tax reporting rules. To this end CFOs and their accountants use the double-entry bookkeeping method (first documented by Luca Pacioli 530 years ago (see Luca Pacioli, “Abhandlung über die Buchhaltung 1494”, C.E. Poeschel Verlag, Stuttgart 1933)).

Most countries and international accounting standards (IFRS and US GAAP) require inventories to be valued at full production cost in reporting. Full costing also applies to the calculation of transfer prices between companies in different countries. Due to this CFOs want to set up their cost accounting system to value inventories at full cost and to show the cost price per unit.

If managers responsible for strategic and operational management leave the design of the management accounting system largely to the CFO, he will place the emphasis on fulfilling his information requirements and thus on inventory valuation at full cost of sales.

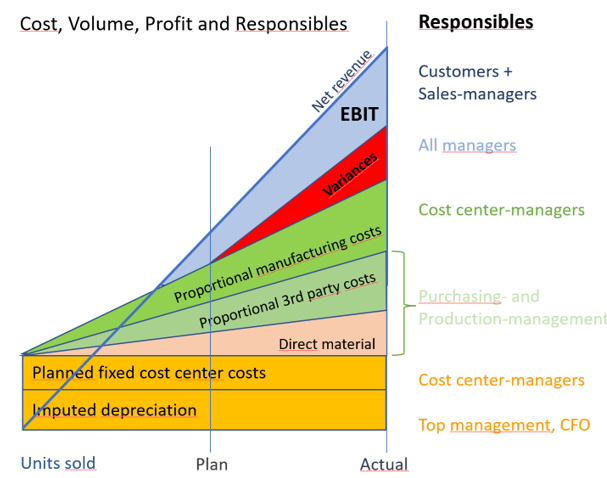

The CEO and his managers, on the other hand, plan and control capacities (personnel and equipment), order-related consumption of materials, external services and work performed by the cost centers. Thus, they expect the management accounting system to show the net revenue, the proportional product costs and the contribution margin for each product or service unit. Net profits are only generated if the contribution margin volume is greater than the fixed cost total in a period.

To fulfill this purpose the planned costs must be split into their proportional and fixed components in the cost centers performing the work. Fixed costs are incurred for the cost centers’ readiness to perform. They are incurred for periods of time (month, year) and are determined by management decisions. Proportional production costs are incurred when products or services are manufactured:

-

- Bills of materials record the planned consumption per unit and result in the direct material costs,

- Work plans show the processing time for each item per production cost center. Multiplied by the proportional planned cost rate of the cost center, the proportional manufacturing costs are calculated.

Thus, any decision-oriented management accounting system must be able to split the planned costs into their proportional and fixed parts. Calculations must show for each product or service unit which material and

third-party service costs are directly caused by the units produced (proportional) and which are the (fixed) costs of the readiness to perform in the cost centers. This is because the contribution margins are used to cover the fixed, mainly period-dependent costs, and the profit.

When designing the decision-relevant management accounting system, it is important to keep in mind:

-

- Fixed costs are incurred for the creation and maintenance of the company’s readiness to perform. Managers usually plan personnel and machine capacities on an annual basis and control them monthly.

- Production of products and/or services causes proportional costs. They are incurred with each unit produced. To calculate them, bills of materials and routings are required, which cannot be found in the accounting system, but only in the ERP system.

- Management accounting must be able to calculate the flexible budget per cost center. It shows the planned proportional and fixed costs based on the actual performance of the cost center. This step is necessary because customers rarely order exactly what the company planned.

- The difference between the flexible budget and the actual costs is the spending variance. It is calculated and presented in every cost center per cost type. The cost center manager has the task to keep spending variances low.

- As there is no direct causal link between the units produced and the flexible budget costs of a cost center, spending variances are transferred from there to the operating result (EBIT).

- According to the causation principle costs for excess plant capacity cannot be allocated to the units produced and sold. This is because depreciation is the result of investment decisions made earlier by top management. Depreciation costs for assets can only be clearly allocated to the cost center or to the whole company.

In summary even well-developed financial accounting systems are neither suitable for costing nor for corporate management. They cannot map direct cause-and-effect relationships, as the data link to the specified quantities and times in the parts lists and work plans is missing. Information on the products sold and the net revenue generated with a given customer can only be found in sales order processing and invoicing, not in financial accounting.

Decision-relevant management accounting requires the use of flexible budgeting in the cost centers and of contribution margin accounting. In English-speaking countries, this method is known as Resource Consumption Accounting RCA.

An analysis with ChatGPT (10/14/2024) revealed that the following companies offer RCA-enabled software:

-

- SAP (SAP Profitability and Performance Management)

- Microsoft AX

- Infor (Infor CloudSuite Industrial or Infor ERP LN)

- Prophix

This list does not claim to be exhaustive. Our practical experience is based on our customers’ implementations with SAP, Infor and Microsoft AX.