Last Updated on March 11, 2024 by admin

In accordance with the goal orientation in the entire management (see the post “Integrated Management System”) it is also necessary to record values to be achieved for specific persons in the income statement. Multidimensional contribution accounting can make a significant contribution to this.

Multidimensional contribution accounting

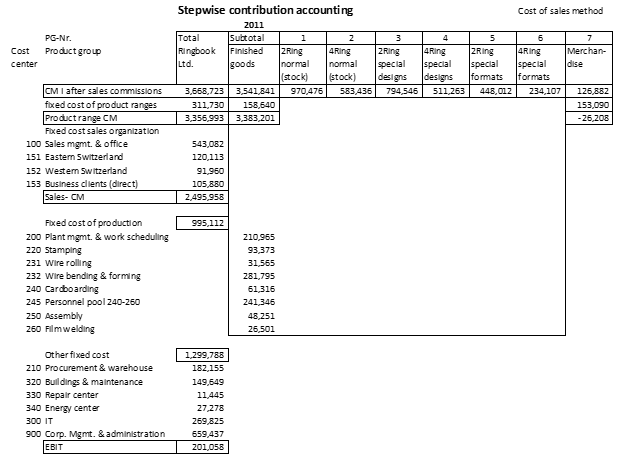

Contribution accounting must be structured according to the structures in the company. For the example enterprise, the following plan results: We start with the sales and the sales deductions. The proportional standard product costs are deducted from these, which results in the Plan CM I. The planned sales commissions are subtracted from this. This in turn results in Plan-CM I after sales commission of 3,668,723.

The two assortments and the product group structure are shown horizontally. In this way, the CM I for each product group is visible. In the simulation model, this observation is possible at the individual item level.

This means that all proportional costs of sales are included (withdrawal from the finished goods warehouse at standard). Vertically, the fixed cost center costs are assigned to those areas where they can be clearly influenced and thus justified. The entire process of showing directly controllable fixed cost blocks is based on this responsibility without using any keys for fixed cost allocation:

-

- The company plans the costs for sales promotion in the cost centers “Sales Promotion Own Products” and “Merchandise”. These are fixed product range costs that can be assigned uniquely to the assortment, but not to the product groups or even the individual articles.

- The sales area consists of the three cost centers for the sales areas and those for sales management and internal sales. As these organizational units sell all articles of Ringbook Ltd., the fixed sales costs can only be assigned to the total of all contribution margins.

- The total fixed costs of the production area (995,112) can only be clearly assigned to the range of own products, since the employees take care of all own products.

- The remaining cost centers from the warehouse to management and administration work for the entire company, which is why they are only presented in the “Total company” column.

The result is the planned EBIT (earnings before interest and taxes). Assuming that the EBIT of 201,058 also corresponds to the profit objective for the year, the following responsibilities can be derived:

-

- The company manager is responsible for achieving the planned EBIT.

- The cost center managers are responsible for keeping to their target costs. These are the planned costs of the activity actually performed (explained in detail later). In all cost centers that are not directly involved in product creation (that is, they do not appear in any work plan), the target costs correspond to the planned fixed costs.

- The head of procurement is responsible for realizing the planned (standard) purchase prices.

- The top sales manager is responsible for the complete sales-CM. This includes the net revenues, sales commissions, planned proportional cost of goods manufactured, and the fixed costs of the entire sales organization. This responsibility can be partially delegated to sales area managers, since they are responsible for the CM achieved in their area and their own fixed costs. It can also be delegated to assortment managers or heads of promotion areas. If there is responsibility for both, regions and assortments, this results in a “crossed responsibility” (more to this at the end of this post).

These explanations are intended to show that the structure of the multilevel contribution accounting system allows obtaining financial targets that fully correspond to the ideas of Management by Objectives. It is important that the multilevel CM-calculation is designed according to the conditions and structures of the company (not according to the textbook).

If the sales, turnover and net proceeds are planned in all relevant dimensions of sales as described in the post “Planning from the Market into the Company”, the CM calculation can be created not only multilevel but also multidimensional. The prerequisite is that both product and customer structures are structured and planned bottom-up.

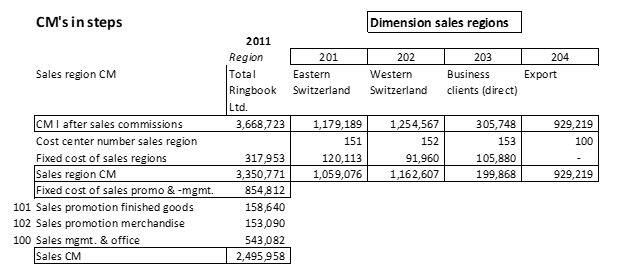

Contribution margin accounting for the sales areas is created by evaluating sales planning according to sales areas and the cost centers assigned to them. Each area manager has his own cost center for which he plans the fixed costs, which he can directly influence and therefore be responsible for. These are fixed costs because they have nothing to do with product manufacturing, but with the sale of all items. If this cost block is subtracted from CM I after commissions, the area CM (sales region) is the objective to be achieved.

No fixed costs were directly assigned to exports because the sales manager together with his office staff wins and handles all foreign sales in addition to his management task. According to this organization, the fixed costs of exportations are included in the cost center sales management and internal sales support. Using an appropriate allocation basis, these fixed costs could be distributed between export and sales management. But the consequence would be that nobody would be responsible for the fixed costs of internal services neither for exportation. This example shows why the structure of the database and of the profitability analysis always has to be set up according to the organizational circumstances.

The sales contribution of 2,495,958 is the same as the one in in the dimension of product groups. All the fixed costs below remain the same since the cost centers for production and the other areas work for all sales areas. This again results in the same EBIT.

The salespersons planned sales volumes and revenues per product group and sales area, but not by sales channel. Therefore, in planning, CM-accounting cannot be created according to sales channels. In the actual view, however, this will be possible, since the customer number in the invoices indicates the channel to which the customer belongs.

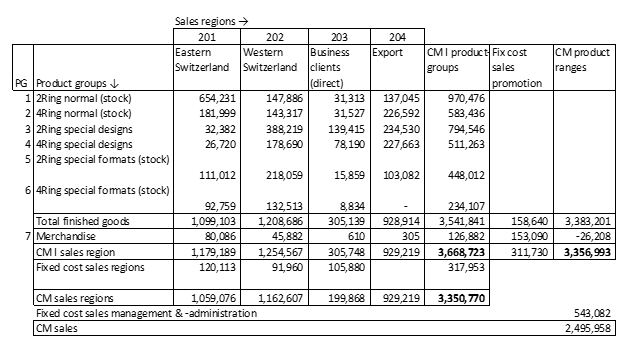

Today it is common practice in many companies to cultivate the market along various dimensions (for example, territories, sales channels, product groups). For each of the dimensions, the same total sales and contribution margin totals are to be achieved. As mentioned, the top sales manager is responsible for the complete sales CM. In order to achieve it area managers must coordinate with product managers. A sales promotion campaign for certain products (or product groups) should result in salespersons specifically recommending the respective products in their presentations and making targeted use of any available advertising material.

This coordinated approach can be supported by cross-referencing the results targets. The columns show the contribution margins planned in the individual sales areas for each product group. In the rows, the sales promotions planned for the product groups are compared with the target CM. It can be seen that the budget for the promotion of the still small merchandise area is almost as large as that for the own products. The intention here is to promote the merchandise area. This requires salespeople making their customers more aware of the advantages of the merchandise assortment.

Contribution margin accounting is a powerful tool to support objective-oriented approaches and, in particular, for promoting coordination between all areas of an organization. It can be adapted to changing corporate structures. This also applies to strategic planning. Because there it has to be decided with which products the company wants to reach which market positions in the future and thereby make the profit targets become reality. To do this, it is necessary to know which sales volumes and net revenues will be added and which will be eliminated, which costs will be incurred by the products (proportional) and which capacities and structures will have to be rebuilt for the necessary success potential (fixed).

In operational terms, contribution margin accounting helps to enable management by achieving agreement on objectives. It provides the tools for agreeing on targets for sales and net revenues down to the individual order or customer. Cost targets are mapped in such a way that they correspond to the direct influence of the holders of the objectives. The proportional manufacturing costs of an item are the target value for consumption in production. Finally, the planned fixed costs are the budgets for maintaining performance, whether in one area or in the entire company.