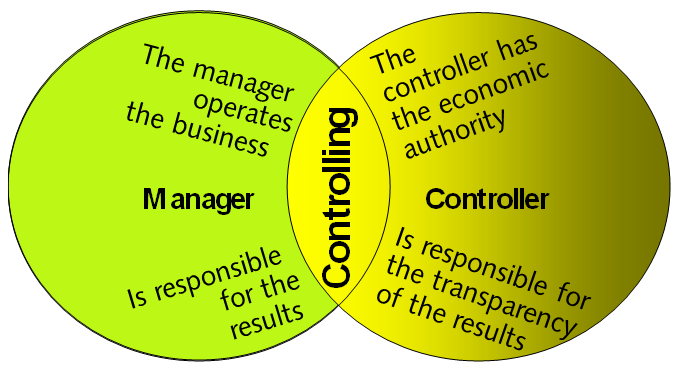

Why management-relevant cost terms?

Enabling management control requires decision-relevant cost and revenue terms. Every manager is dependent on being able to identify which variables he can directly influence and therefore should also be responsible for in his area. He must be able to recognize in which time period he can change what cost and revenue parameters. Finally, he wants to be sure that only those cost items are charged to his area that can be unambiguously assigned.

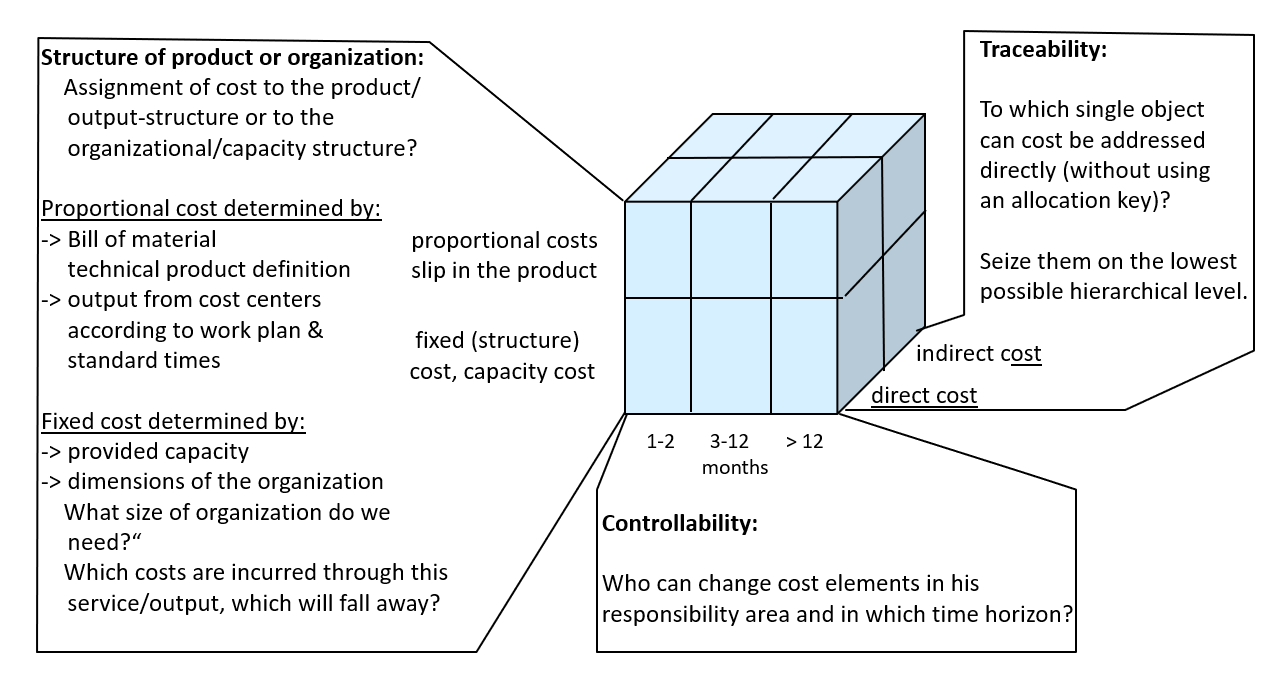

This requires viewing costs in three dimensions according to their intended use and mapping them in the management accounting system:

These three dimensions interpenetrate each other, which is why they should be represented in a cube (see the cost cube in the Controller Dictionary, p. 146):

What does this mean for the design of Management Accounting systems?

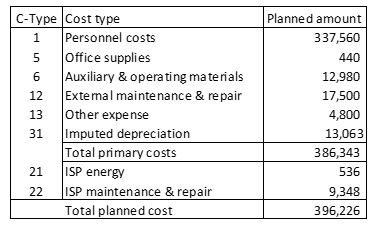

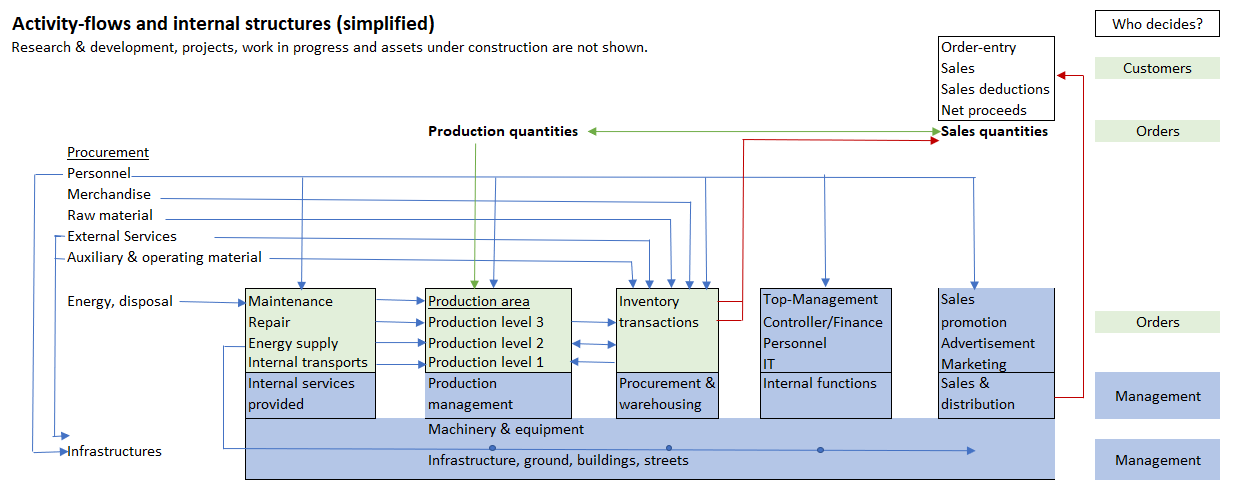

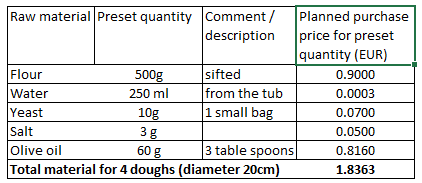

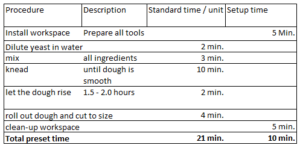

Costs are to be planned by the unit whose manager is also directly responsible for them. Personnel costs and most third-party costs arise in the cost centers (except material). The same applies to depreciation. Material costs and product-related external services are incurred for the products. They are represented in bill of materials items and are therefore included in the costing of the products. The production managers are responsible for this. These costs are therefore to be planned and accounted for by cost center managers and product-responsible managers.

For all managers, it is important to know in which period of time their costs (and the procurement prices behind them) can be changed. In the case of personnel costs (they always arise in cost centers), hiring, notice periods, negotiated wages and rates for social benefit costs determine the period in which the costs can be changed. In the area of material and external service costs, order quantities and the agreed contract and delivery conditions determine the costs.

From the point of view of traceability, in Management Accounting, both planned and actual costs (or expenditures) must be assigned to the area that is directly responsible for them. The costs of the unit’s own employees are direct costs for a production cost center since each employee is permanently assigned to that cost center. For the orders processed by the cost center, they are indirect costs because an employee usually works on different orders in a given time period. The same applies to the consumption of operating supplies, external maintenance work, or depreciation. Direct costs of products are the raw materials and semi-finished products consumed (ex warehouse) and of externally procured external services. These items can be clearly assigned to a production order. The key to recording purchases and consumption in a management-oriented manner is therefore the account assignment of the documents (supplier invoices, payroll accounting, material procurement from stock).

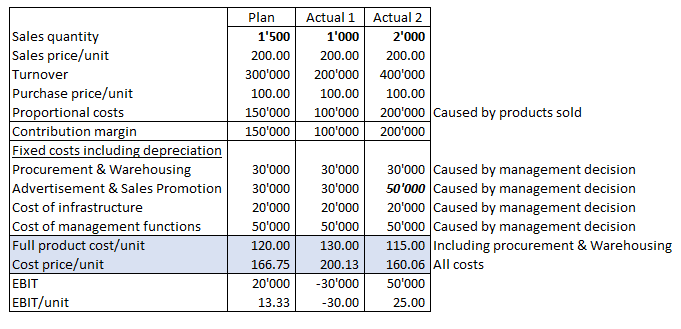

In the third dimension, a distinction is made as to whether costs are caused directly by the units manufactured or sold (products or services) or by decisions that determine the capabilities of the organization (capacities of all types, size of the organization, training and further education or management services). The former are referred to as proportional costs, while the capability/capacity costs are mainly called fixed costs or structural costs.

Proportional costs are determined by sales and production, while fixed costs are determined exclusively by management decisions. To staff the anteroom of a member of the management board is a management decision just as much as the approval of a sales promotion campaign, the decision to convert existing production facilities, the purchase of vehicles for delivery or the introduction of an ERP system. Proportional costs are determined by production quantities, bills of material (where the planned consumption quantities are recorded), work plans (containing the planned times for the individual production steps in the cost centers) and planned purchase prices for raw materials and order-related external services. In a purely trading company, the purchase price for the product sold corresponds to the proportional costs, since nothing is changed in the product. All other costs of trading operations are structural costs.

To avoid confusion: We have replaced the term variable costs with proportional costs (see Controller Dictionary, p. 200), because in practice and science proportionality is often confused with controllability. If the activity of an employee in a production cost center is causally necessary for product creation (can be seen in the work plan), these are proportional costs. They are added with every unit produced. If the same employee has nothing to do due to a lack of orders, his wage is still paid, but becomes a fixed cost (reserved or unused capacity). How long the wage will continue to be paid despite underemployment (controllability) is a question of notice periods and the management’s decision what to do with this employee. From this it can also be concluded that everything that is not proportional becomes fixed costs.

To distinguish clearly between proportional and fixed costs is extremely important for the design of the management control system. For both operational and strategic decisions to be made, it must be known which costs are directly caused by the products and their sales and which will be the result of decisions on capacities and structures of the organization.