Customer profitability

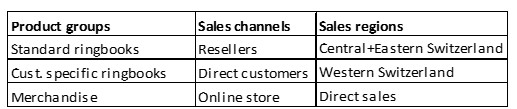

The example company Ringbook Ltd. sells various ring binder types as well as merchandise items to approx. 50 customers. In each of the regions of Eastern and Central Switzerland and the rest of Switzerland, one salesperson supports the resellers. Another sales representative sells the entire range to corporate customers who use the ring binders for themselves. All items can also be ordered directly from the online store. The sales and marketing manager is responsible for exporting the ring binders to other countries. The following dimensions are therefore to be provided for the planning and control of sales:

These cost centers were defined for the Marketing and Sales organization:

-

- Sales management (incl. export and online store)

- Sales Eastern and Central Switzerland

- Sales rest of Switzerland

- Sales to direct customers

- Sales promotion of own products

- Sales promotion merchandise

Such structures for planning and controlling the sales dimensions and the cost centers of marketing and sales can be found in many companies in a similar form.

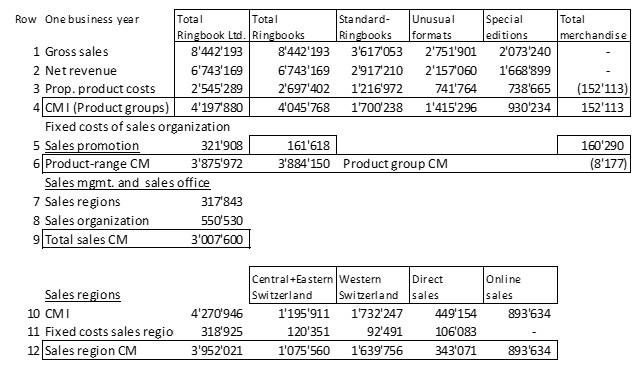

For an example year the following contribution margins resulted:

In Ringbook Ltd. the gross sales, the sales deductions, the proportional planned manufacturing costs and the contribution margin I (CM I) per sales order item can be determined. Aggregation of all order items of a customer shows the CM I per customer and year. Lines 1 – 4 show the totals per product group.

Sales promotion is done separately for the product ranges own products and merchandise. For each of these a sales promotion cost center is maintained, each with its own personnel. Their costs can be clearly allocated to the respective assortment, but not to the individual customers or items (line 5). The contribution margin of an assortment can be seen in line 6.

Actual sales are generated in four sales territories. There are three sales cost centers for the areas of Eastern and Central Switzerland, the rest of Switzerland and direct sales to companies. Their costs are incurred for servicing the customers in the three sales areas and can therefore be clearly addressed to the sales area contribution margins (lines 10 – 12).

The sales manager and his office staff take care of the export sales and the operation of the online store. No separate cost centers can be defined for these areas, because the work is performed in conjunction with all the other tasks of the sales management and office staff. All costs of the cost center Sales Management and Internal Sales Support are therefore incurred for the entirety of the sales. They cannot be allocated to sales areas or product groups according to source (line 8).

In multilevel and multidimensional contribution margin accounting it is possible to calculate absolute contribution margins for various areas of responsibility after deducting the directly assignable fixed costs. The managers of such areas can be responsible for CM I and the fixed costs directly caused there (line 9).

Profitability of a customer

If the invoiced items and the proportional (planned) product costs of the sold items are known for each customer, the contribution margin of a customer can be calculated. However, if parts of the fixed costs are also to be allocated to individual customers, multiple unsolvable allocation problems arise:

-

- The internal sales department handles all incoming orders

- The sales manager takes care of the planning and control of the entire sales area and this across product groups, sales channels and sales territories.

- The sales promotion units promote the product ranges of own products and merchandise in all sales regions and sales channels.

- The regional sales representatives serve customers of different sizes in their areas, who have different needs for advice.

- Marketing and sales costs are also incurred for addressees who do not become customers.

There is no direct causal relationship between the contribution margin of a particular customer and the fixed costs of sales and all other cost centers of the company. An allocation of these fixed costs can only be practiced by using allocation keys (or drivers). Even using differentiated allocation keys does not help as no cause-effect relationship exists (see the post “Full product costs are always wrong!”).

If a new customer is acquired, it can be estimated what and how much he will purchase annually and how much contribution margin could result to cover fixed costs and profit. However, the prerequisite is that management accounting is structured as a multidimensional contribution margin accounting.

The level of fixed costs is determined by the managers of the respective management areas. If an existing customer drops out, the fixed costs do not change, but there is less contribution margin available to cover them.

In a company with several customers, it is therefore impossible to clearly calculate the EBIT of a single customer and thus its profitability.