Last Updated on March 12, 2024 by admin

Full product costs are always wrong!

An engineer and board member wanted us to develop a costing system that shows the profit before deduction of interest and taxes (EBIT) by product (item number). This would require calculation of the full manufacturing cost and the cost price per item number (net revenue – cost price = EBIT).

We did not accept this engagement!

Scientifically and empirically it has been shown that full production costs or even cost prices cannot serve as reliable decision-making information. Nevertheless, the methodology of the “cost distribution sheet” is still being taught at many schools and is extensively used in practice. Even for a simple trading company that only sells one single product, the inadequacy of using total cost (EBIT) per unit for decision-making is clear. While the purchase price per unit is agreed with the supplier and can be clearly assigned to the sold unit, that is not the case with other costs:

-

- The procurement costs (packaging, freight, insurance) depend on the quantity ordered. They are caused by the purchase order (decision), not by the individual piece.

- The costs of the purchasing department (personnel and material costs) are determined by the size of the department (decision) and only indirectly by the quantity purchased.

- Advertising and sales promotion costs are also the result of decisions on selling activities. These costs are also decided before sales are made. These cannot be related in a direct cause-effect-relationship to the quantity of units planned or actually sold.

- This also applies to infrastructure and to the costs of managerial functions.

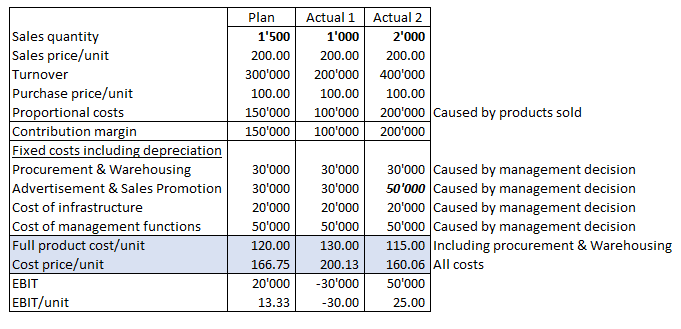

The following example shows how the full production cost and the cost of goods sold change when planned and actual quantities or other structural costs differ (method: simple fixed cost allocation):

Although the costs directly incurred by the product sold are always the same, each situation presented gives rise to a different full manufacturing cost or cost price per unit. This is due to the fact that the structural costs (fixed costs) determined by management decisions were allocated to the product unit based on sales volume.

If the example is extended to a company offering several products and possibly also producing semi-finished products, additional cost allocation keys would have to be used. This is because the parts delivered to inventory would have to bear a proportionate share of the fixed costs of procurement and production readiness (full production costs). The fixed costs of sales and marketing, of the remaining internal functions, and of overall management would have to be allocated to the units sold in order to calculate the cost of goods sold per unit. Whatever allocation factors are used to achieve these allocations is therefore always wrong. This is because all fixed costs are a result of management decisions (budget) and are only indirectly dependent on the units produced or sold.

Only the costs caused by the actual production of a product unit can be clearly assigned to a product unit. Behind these costs are the consumption of raw materials, external services, semi-finished products, and own production activities. These are determined by bills of material, workplans, and recipes (technical cause-effect chains). These are the proportional (planned) manufacturing costs. There is never a direct causal relationship between the fixed costs of the support functions and the units manufactured or sold.

In other words:

There is no such thing as a doubt-free profit per unit before interest and taxes (EBIT), because it is calculated based on arbitrarily chosen allocation factors.

There is also no such thing as “as far as possible cause-based allocation” because, due to the lack of a direct cause-and-effect chain, an allocation factor must be used anyway.

This insight must be taken into account when designing decision-relevant management accounting systems. Managers correctly argue that they should only be responsible for cost elements they can directly influence themselves.