Activity Based Pricing

Five of ten case studies published so far by the Profitability Analytics Center of Excellence PACE (see Management Accounting Practice Reports) deal with the question of how the unequal, only partially measurable use of a company’s support areas and capacities can be taken into account in sales pricing for different customers.

Specifically, the following cost pools should be included in sales pricing for different customer/product combinations:

-

- Costs of procurement and warehouse logistics, which vary for different product groups,

- Scrapping costs for expired or unsaleable products per product group,

- Distribution costs such as transportation, storage, replenishment of shelves, delivery cycle (daily, weekly, monthly) per customer,

- Customer care costs for order processing, handling of returns and complaints and general support by the sales force.

Although these fixed cost blocks cannot be allocated to an individual product according to cause, it is possible to calculate average values per activity and then take these into account when setting prices for different customer groups or sales channels.

This does not change anything in the management accounting system or in the contribution margin methodology, nor does it change the decision-relevant internal inventory valuation (at proportional standard costs). This is because fixed cost center costs are related to executed processes.

Activity Based Pricing is intended to support marketing- and salespersons in justifying the estimated costs of fixed cost processes to customers. For this purpose, it is not necessary to adapt the management accounting system, which is used for planning and control, but parallel calculations can be created.

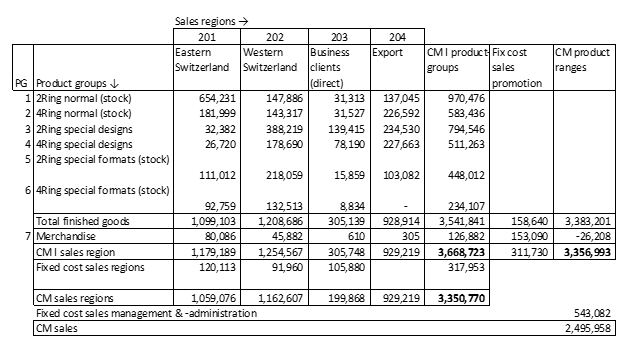

Application example Ringbook Ltd.

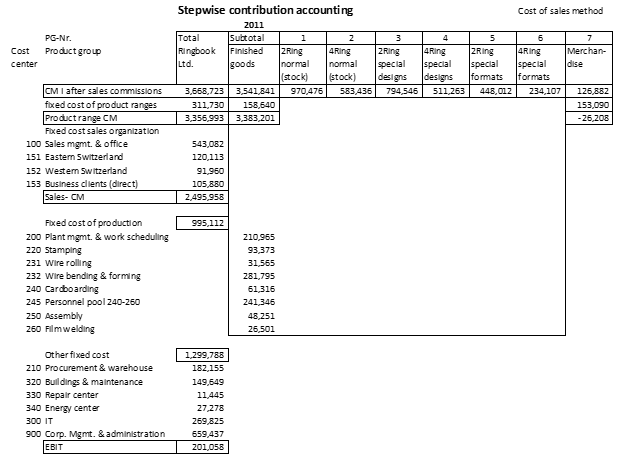

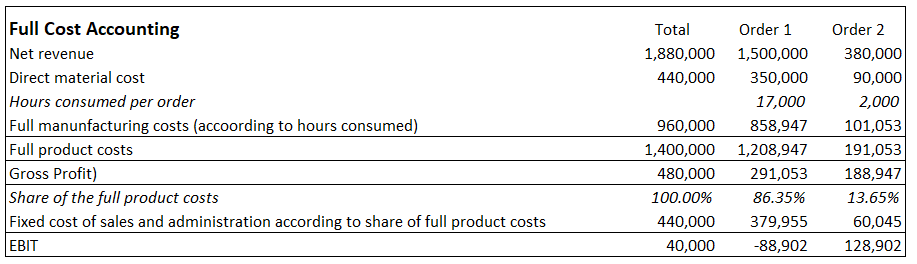

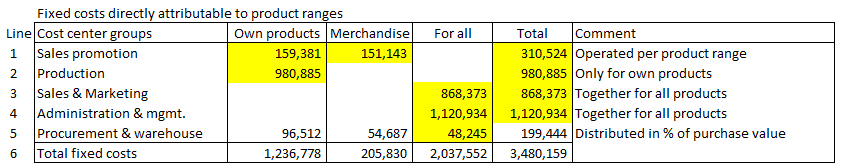

For the example company Ringbook Ltd. the following table shows the fixed costs for 2021 at the lowest product level to which they can still be clearly allocated, i.e., without using any fixed cost allocation factors.

Of the total fixed costs of around 3.48 million, 1.44 million can be allocated to the two product ranges, while 2.04 million are incurred for the entire sales organization. The fixed costs for purchasing and warehousing were broken down in proportion to the purchasing values of the areas (own products, merchandise, investments and projects (general)). This took place under the arbitrary assumption that the costs of the purchase department are driven by the purchase volume.

With this classification the lowest level of the allocation of fixed cost blocks is reached in the example company. For:

-

- Sales promotion is performed in each case for all products of a product range, for all customer groups together.

- In sales and marketing all products are sold to all customers and a sales order can include one or more positions.

- In production, manufacturing orders are processed for both semi-finished and finished products, which is why their fixed costs are incurred for all manufactured goods.

- Administration and management work for all products.

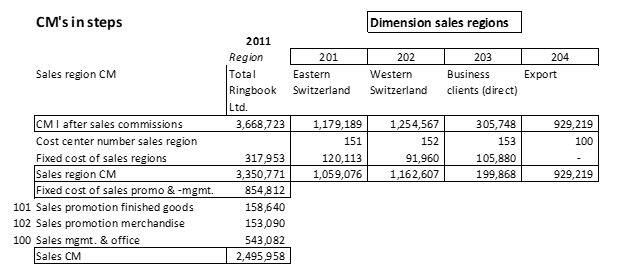

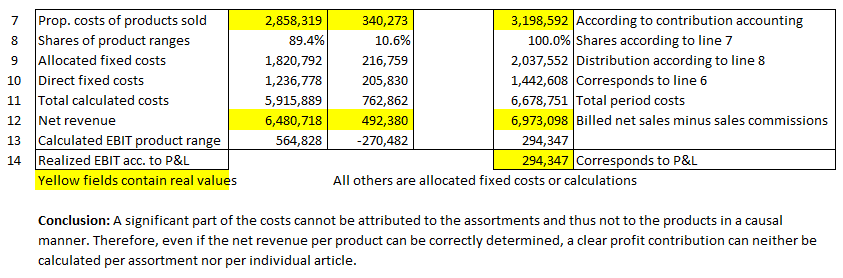

The next part of the table (lines 7 – 14) is based on the proportional manufacturing costs of the products sold in the two assortments of own products and merchandise. Since the calculation is based on bills of materials and routings of the individual articles and the purchase prices for the individual merchandise products are known, their proportional costs can be calculated for each assortment according to their origin (line 7). From this, the proportions of the general fixed costs per assortment can be calculated in lines 8 and 9 (89.4% and 10.6%). In line 10, the directly attributable fixed costs are taken from line 6 of the previous table. This results in the full costs per product range in line 11.

Comparing the net revenues in line 12 with the calculated full costs in line 11, reveals the calculated EBIT per product range (line 13). The total EBIT of 294,347 corresponds to the EBIT in the P&L (line 14).

After this allocation of fixed cost blocks to products it can be seen that the large share of EBIT comes from the own products. This was already apparent from the stepwise CM-calculation.

If the activity-based fixed cost allocation presented here is taken as the basis for pricing, the prices of merchandise would have to be increased and those of the own products reduced. In this way, the merchandise would achieve a higher calculated EBIT and the lower prices of the own products would allow sales volumes to be increased. However, the merchandise range has only been sold for two years, so it is still being built up. The sales prices have been set by observing competitor prices, so a price increase would lead to a drop in sales. Otherwise it makes no sense to lower the prices of own products, because no significant increases in production volumes are possible with the existing production capacities.

In summary, for the estimation of activity costs the fixed costs of a cost center are to be assumed and these are to be compared with the process quantities. Using the example of a purchasing department it is understandable that an initial purchase from a supplier takes more time than a reorder. The personnel costs in the marketing department for producing a sales catalogue remain the same whether one or thousands of catalogues are printed. But the full cost of one catalogue will change. The question whether the costs of the catalogues are to be split between existing and potential customers remains open.

Outlook

The more interwoven the internal service relationships are in the production and marketing of products, the less meaningful a cost-based sales price calculation becomes.

For the determination of gross and net sales prices, the allocation of fixed costs to customers and products can be a support. However, the net prices of competitors are more important.

Activity Based Pricing should in any case take place outside of Management Accounting. It is used to set prices but does not directly change any costs.