Depreciation of Fixed and Intangible Assets

Buying a car privately

If private individuals want to buy a new car, they first determine how much they will have to pay for the desired vehicle including all equipment features. This results in the gross purchase price of the vehicle, which is then also shown in the purchase contract. If her used car is traded in, the trade-in price is deducted. She may prefer a leasing contract with monthly payments. When making the decision, the private individual mainly considers the cash outflows at the time of purchase and the ongoing annual expenses. Such an investment calculation only takes cash flows into account.

Why write off?

A company, on the other hand, must present a financial statement with a profit and loss account every year. To determine the annual profit for the period, it must deduct the annual loss in value of the car, i.e. depreciation, from the revenue generated and show it in the income statement and in the balance sheet.

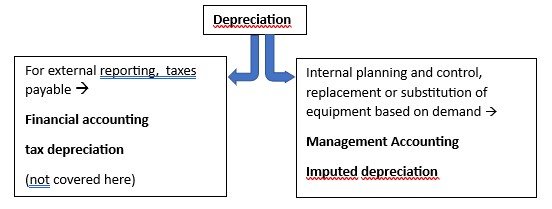

Depreciation is the value-based expression of the annual loss in value of physical and intangible assets. External reporting and the calculation of taxes payable are governed by legal regulations. These regulations are intended to ensure that all taxable companies report according to the same rules and are therefore treated equally by the state. The management approach, on the other hand, focuses on the loss in value of an asset or right due to its use and the expected remaining useful life of it. These different purposes can lead to different depreciation amounts being included from an operational perspective than those permitted under tax law.

External or internal valuation

In order to treat all their taxable companies equally, many countries issue commercial and tax regulations on the valuation of assets, the depreciation methods to be applied and the useful lives permitted for the calculation. In Germany, for example, these are the depreciation rules (depreciation for wear and tear), cf. the depreciation table of the German Federal Ministry of Finance (Bundesfinanzministerium – AfA-Tabelle für die allgemein verwendbaren Anlagegüter (AfA-Tabelle “AV”)). For internationally operating and reporting companies, the rules of international reporting standards such as IFRS or US GAAP are applied.

For the managers controlling a company or a group these external valuation and depreciation rules are of secondary importance. They want to be able to assess whether the depreciation and amortization charged to the internal financial statements will be sufficient to maintain the company’s performance potential in the future so that it can continue to generate profits in line with the market. Distributions (dividends) to owners and shareholders should therefore only be decided once it has been ensured by means of imputed depreciation and amortization that funds that will be required to maintain the profit potential will not be distributed.

“Management control plans, controls and measures the implementation of guidelines, strategies and operational objectives, see the management control definition.

From this understanding of management control it can be deduced that management accounting must take into account imputed depreciation, not financial depreciation. This is because it is about shaping the future of the company and only to a limited extent about external profit reporting.