Personnel costs in Cost Accounting

In this post we understand personnel costs as the costs for the work done by the employed persons . The costs of external persons who work for the organization are not included since the wages of these persons are accounted for and paid out in the performing organization.

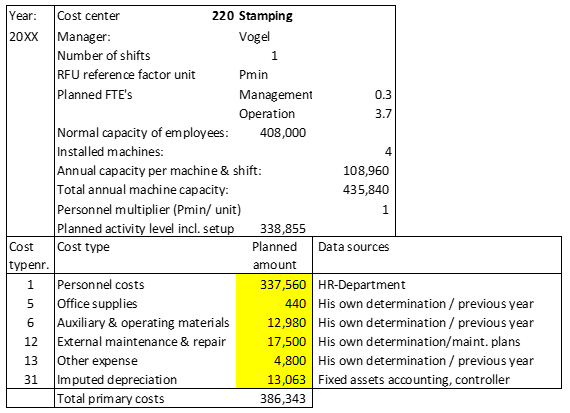

Each person employed by an organization is assigned to a cost center, usually the cost center of the person’s boss. If employees perform work for projects, their personnel costs are incurred in the cost center of origin and, as far as measurable, are charged to the projects as internal services with corresponding hourly rates. Each employee is assigned to one and only one cost center. Should a person have two employment contracts in the same company, these are to be assigned to the respective cost centers.

Cost center managers are responsible for the costs of their personnel . Therefore they want to know the monthly personnel costs of their management area in plan and actual.

Requirements for the personnel department, financial accounting and software

Payroll accounting is becoming increasingly complicated, since different types of non-wage labor costs have to be taken into account and since payments occur at different times, e.g. monthly salary, vacation pay, Christmas bonus, child allowances, gratuity, bonus. For each employee, the payroll must usually be created monthly in the payroll system for each wage type and wage deduction type. This detail is necessary that employees can understand what net amount is due to them and is to be paid out per payroll period.

The payroll accounting system must also be structured in such a way that the social insurance companies, the governmental control organizations and the auditors can understand whether all wage and wage deduction items have been calculated correctly. For the company’s own financial accounting, this system must prepare the expenditures for wages and salaries and deductions according to expense types so that they can be posted and checked on an accrual basis.

In most countries, employees receive a monthly pay slip. This shows the contractual gross wage earned in the period and which allowances for overtime and shift work have been accounted for and credited. If supplements for 13th month wages, vacation or Christmas bonuses have been agreed in the employment contract, these items are also listed in the wage statement for the month of payment.

Deductions to be borne by the employee are subtracted from the resulting wage total, e.g. employee contributions for social security and health or accident insurance, in various countries the wage taxes, contributions to pension insurance and similar. This results in the net wage to be paid out for the individual. The company must pass on these deductions to the relevant governmental organizations or insurance companies.

In cost center accounting, however, it is not the cash flows and settlements that are relevant, but the consumption of a reporting period.

Information requirements of cost center managers

Cost center managers are responsible for the costs incurred in their management area that can be directly influenced by them. Consequently, cost accounting must be designed that the personnel costs of a period can be compared with the work performed in the period.

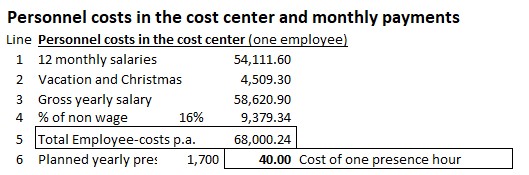

For this purpose, it must be calculated in planning how much a certain person should cost per hour of presence according to the employment contract, if all wage components and the non-wage costs to be paid by the employer are included. Example:

In the example, it is assumed that the person, including the 13th month’s salary and possibly other fringe benefits, is to receive an annual salary of 58,620.90 and is to be present for 1,700 hours (212.5 working days of 8 hours each) in accordance with the annual work calendar. For the non-wage costs to be paid by the employer (i.e. unemployment insurance, pension plan, possibly health insurance), a surcharge rate of 16% on the gross wage sum was calculated. In total, this employee costs the company EUR 68,000 per year or EUR. That is 40.– EUR per planned hour of presence. This is the key information for the cost center manager: For each work/presence hour, this person costs the company EUR 40.

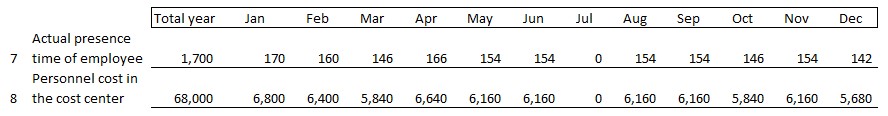

If this person works exactly the 1,700 hours during the year (line 7), the following personnel costs result according to the recording of the presence time (line 8), for which the cost center manager is responsible:

In the example the company is closed for company vacations during July. Since the employee does not have any presence hours in July, no personnel costs are debited for him, although he receives a salary payment. This is because the hours were worked in the other months (the total presence hours in line 7 is 1,700 hours). Even if the employee is paid the same wage every month, it makes sense for the cost center manager to see the personnel costs based on the really worked hours .

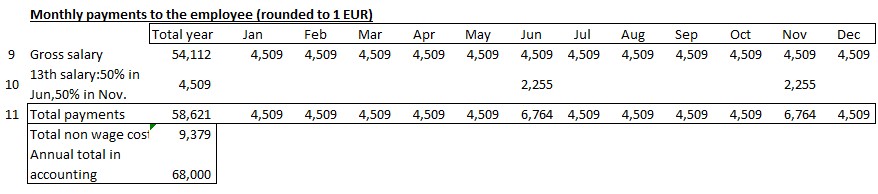

However, in payroll accounting and consequently in financial accounting, the payment values can be found. They differ from the costs:

In the payrolls, Monthly Payments to Employee 1/12 appears as the gross monthly wage, cf. line 1. Vacation and Christmas bonuses are also included in personnel costs but are paid in June and November. Payments of child allowances are not listed because they are reimbursed to the company by Social Security. Social security costs charged to the company are included in the 16% for non wage costs (line 4). They represent the amounts the company (not the employees) must pay for unemployment insurance, retirement benefits, and possibly health insurance (9,379.34).

The monthly personnel costs are calculated by multiplying the hourly presence rate (line 6) by the time worked. Thus the personnel cost for the work done in a period is charged to the cost center, not the amount from the pay slip (line 8). The data source for charging personnel costs to the cost centers are the amounts from cost center planning and the presence times, not the payrolls for the employees.

Necessary personnel cost-types in management accounting

In many companies it is sufficient to set up only one cost type “personnel costs” in management accounting. This is because in most cases, a person’s hourly presence rate includes all compensation, as shown in line 6. Cost center managers cannot influence the conditions for non wage labor costs because they are governed by regulations. Therefore, as shown in line 4, they can be included directly in the planned hourly rate. This facilitates planning and control for cost center managers.

Additional personnel cost types indicated by

-

- Shift bonuses and/or bonuses for weekend work

- Bad weather bonuses (construction industry)

- Danger bonuses

- Overtime bonuses and

- Bonuses on achieved sales or contribution margins

are to be aligned. This is because these bonuses are planned and settled on the basis of hours actually worked or sales results achieved.