As a result of the Corona pandemic and supply chain challenges, increasing inflation rates can be observed worldwide. As a result, the questions of how quickly and comprehensively rising costs can be passed on to customers and what consequences can be expected for the company’s own results are coming to the fore.

To determine the extent to which price variances in purchasing could be passed on to customers and whether price increases are leading to increased spending variances in the cost centers, it is necessary to record purchase price variances in management accounting for short-term planning and control.

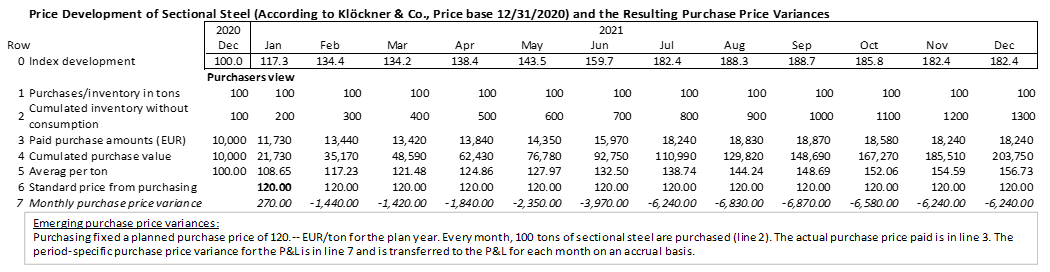

In the example below, the real price development for the purchase and consumption of sectional steel is the starting point for determining the company’s own material acquisition costs. Data origin: cf. https://www.d-a.ch/da/da-home/services/dienstleistungen/preisentwicklungen/stahl-metalle/kbob/kbob-preisindizes-baugewerbe.pdf) .

Row 7 of the table shows the monthly purchase price variances based on the standard price of EUR 120.- per ton.

-

- These variances should be recorded as part of the monthly cost of materials in financial accounting, since the purchase price variance arose in this period.

- In management accounting, however, the planned standard purchase price should be used throughout the whole year, since otherwise production would have to create a new standard cost calculation every month, which would be too late for sales, since new price increases have already occurred in the meantime.

- The purchasing manager should include the expected average inflation when setting the standard purchase price for the plan year. Since he is not a prophet, he can only estimate the price. This estimate goes into the planned product costing and consequently is also applied in the planned contribution margin calculation. The advantage of this is that the standard cost estimate remains the yardstick and the monthly variances can be calculated automatically.

- Stock receipts of semi-finished and finished products are also consistently valued in Management Accounting at proportional standard manufacturing costs, which in turn facilitates the preparation of contribution margin accounting.

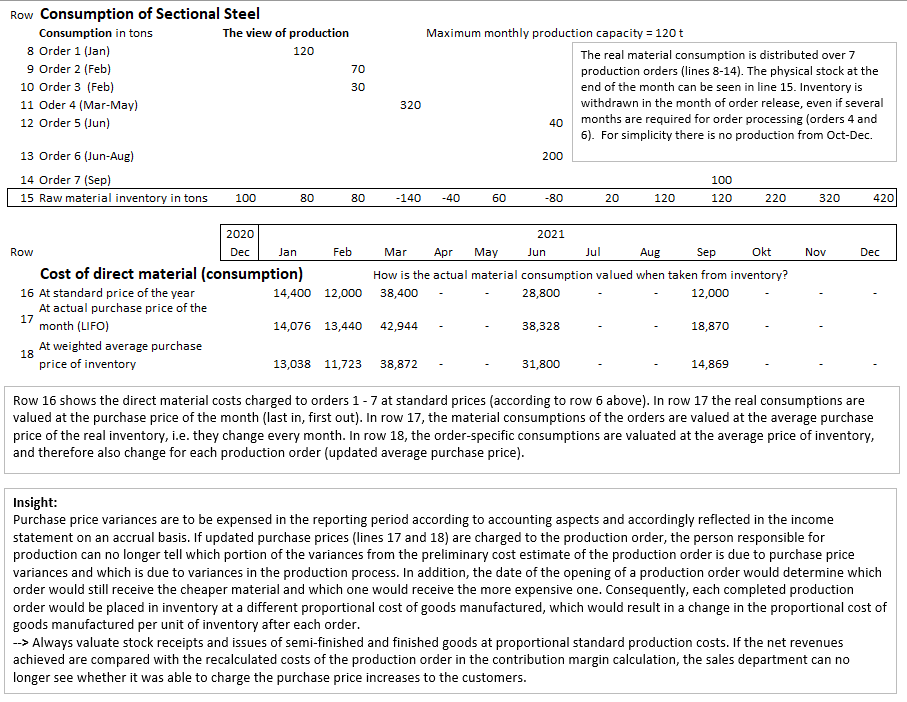

This approach also makes sense because raw materials from deliveries with different real purchase prices can be consumed in the same production order. The table highlights consumption and costs:

-

- Order 1 (row 8) consumes in January the 100 tons of sectional steel purchased in December of the previous year at a price of 100.00/ton, plus 20 tons from the January delivery at a price of 117.30 (row 3 in the price development table).

- Due to its volume of 320 tons the production of order 4 (row 11) has to be distributed over the months March to May. Because 100 tons are purchased each month and charged by the supplier at the applicable price, 3 different purchase prices would also have to be used for the calculation.

- If the smaller order 5 (row 12) were processed before order 4 in early March, it could still benefit from the more favorable purchase price in February of 134.20 per ton at the expense of order 4, but this would increase the cost of order 4.

This complexity of evaluating order-specific consumption cannot be expected of neither the production managers nor the salespeople. In addition, as can be seen from rows 16 – 18, the valuation rule to be applied would still have to be determined:

-

- All purchases are valued at the standard purchase price throughout the year (row 16).

- The real withdrawals from the warehouse are valued at the current purchase price of the month of purchase (Last-In-First-Out, row 17).

- The real purchases are valued at the weighted average purchase price of the current inventory (weighted average purchase price, row 18).

It can be seen that price variances in purchasing are period costs. They can only be clearly allocated to a product if the material was purchased directly for a specific production order.

As a result, especially in inflationary times, order and product costing should be carried out using standard purchase prices. Otherwise, those responsible for production will lose their orientation with the use of rapidly changing prices. In addition, they are held responsible for variances for which they are not responsible.

As mentioned, purchase price variances are period costs. In stepwise contribution accounting they can usually not be clearly assigned to a specific sale. Consequently, they are to be reported where unambiguity is given, e.g. per product or customer group or, as in the example, the assortments (cf. Management Control with Integrated Planning, p. 231).