Target to Actual Comparison

The great benefit of comparing the flexible budget with actual costs is that cost center managers can see every month how well they succeeded in implementing the plan, taking into account the orders processed. The financial goal of a cost center is to meet the cumulative flexible budget costs for the year. If the flexible budget and the actual costs are determined as described in the post “Flexible Budget”, corrective measures can be sought quickly. These should bring the cumulative spending variances back to zero in the next periods, if possible. Theoretically, a target to actual comparison could be made “real time”, i.e. daily. But because the real personnel costs and other cost types can only be calculated after the end of each month, it is recommended to create monthly comparisons per cost center.

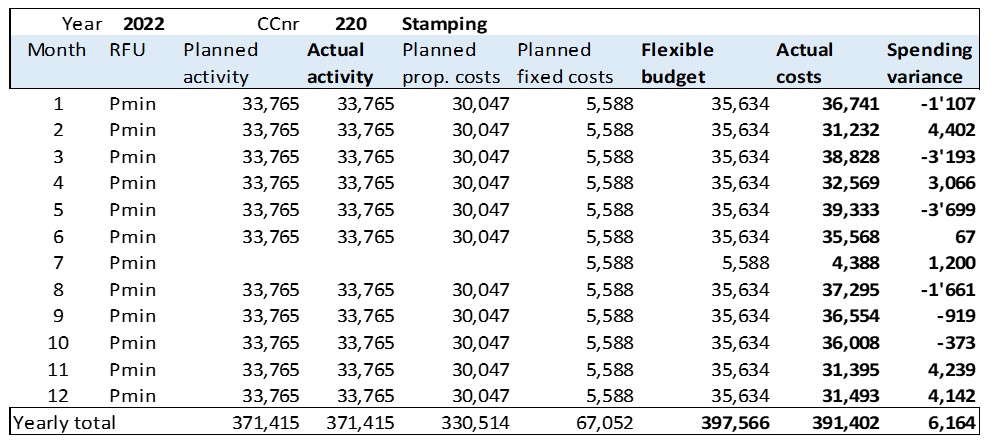

The example shows the monthly target to actual comparisons of the cost center Stamping:

The spending variances show how well the cost center manager succeeded in keeping to the planned costs adjusted to the effective performance in the individual months. A positive spending variance means a productivity gain compared to the plan, a negative the contrary. These variances are corrections of the planned fixed costs.

In the month of July, Ringbook Ltd. is on vacation. Therefore, no activity is listed there, but parts of the fixed costs, especially depreciation, are also incurred in this month. The flexible budget costs are calculated according to the formula “actual output times proportional planned cost rate + planned fixed costs”, the actual costs according to the real charges.

For the year as a whole, the flexible budget was undercut by 6,164.

Actual costs

The costs charged to a cost center for a reporting period (usually a month) are recorded in various subsystems:

-

- Invoices from external suppliers: Recording of the invoice receipt in accounts payable with specification of the consuming cost center.

- Consumption of auxiliary and operating materials from the warehouse: Recording by means of material consumption slips by multiplying the purchased quantity, valuated with the planned purchase price of the auxiliary or operating material. The planned purchase price is used for valuation because the purchase price variances are reported to the purchasing department, since this department triggers the purchase orders.

- Personnel costs: Debit of the presence hours of the month of the employees of the cost center, valued in each case with their planned presence hour rate (data source is the personnel cost plan).

- Charging of activities of other cost centers: Units consumed during the reporting period (mostly hours, kWh, km) valued at the proportional planned cost rate of the providing cost center. As a result, neither the fixed costs of the issuing cost center nor the variances incurred there are passed on.

Overall: The fixed costs and the purchase price variances remain in the sender cost centers, since they can only be recorded and accounted for there. In this way, target to actual comparisons are created in the receiving cost centers without including price or cost-rate changes from serving areas. The resulting variances are the responsibility of the respective cost center manager.