A central task of any management accounting system is to calculate the cost of a product or service. Product costing is necessary for planning, for recording the actual costs incurred, for analyzing variances and for accounting.

To be able to cost a product, the product must be clearly defined. This includes the raw materials, semi-finished products and external services to be used as well as the company’s own work and the quality specifications to be met.

For the preparation of a pizza, a finished dough can be purchased or one can be made at home. If it has to be very quick, a visit to a pizza shop should be planned. Three versions are therefore to be distinguished:

1. Purchase of a finished rolled out pizza dough: weight, raw materials, quality, production method and price are determined externally.

2. Produce the pizza dough yourself: Procure raw materials at market prices, set up and then clean the workplace, process raw materials, mix and knead the dough, check the rising of the dough, roll out, check quality, cut to sheet size.

3. Buy finished pizza in the shop: Type of pizza and ingredients to be selected, pizza dough and size are given by the shop, selling price according to price list (other product).

Purchase or own production of the pizza dough are easy to compare since the end product is more or less identical. If a finished pizza is purchased, it is a different product in which the dough is “only” a semi-finished product. The ingredients and the production of the finished product “Pizza Napoletana” are included in the offer.

A closer analysis of the process “Making your own pizza dough” shows that technical information is required for its calculation, namely the bill of materials (ingredients), the work plan (how you do it) and the lot size (for 4 round pizzas with a diameter of 20cm each).

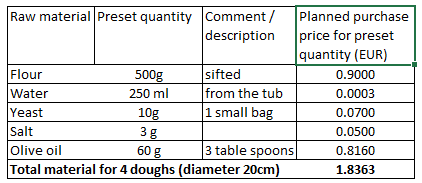

Bill of materials:

This table contains the material consumption required by the recipe. It also includes the flour that must be sprinkled on the table to knead the dough.

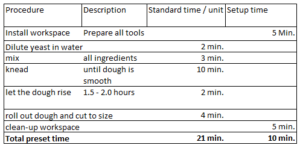

These are the working time consumptions to be planned for dough production. Since various operations are only necessary once and thus independent of the quantity produced, their time consumption is listed in the column “Setup”.

This simple example shows that the quantity- and activity-structure of a product must be known as a prerequisite for costing. The purchase prices and the hourly rate for the working hours can change. The quantities and times are given by the currently valid production process. Consumables are procured from the warehouse (cellar, refrigerator), and services are performed in the cost center “kitchen”. The consumptions recorded in the quantity- and activity-structure are objectives that must be achieved if one is to master the process. In technical terminology they are also called “standards”.

Bills of materials also occur in trading companies, for example, when several products are packed together as a set and sold as one unit. Bills of material and work plans also form the basis for costing in service companies. The main difference from a production company is that the quantity and activity structure can only be determined when the exact customer requirement is known or the product to be delivered is clearly defined. Some examples:

Custom Tailoring: The planned costs of an order can only be calculated once it is known what materials are required in what quantities and which operations with what time requirements will be needed to fulfill the customer’s request.

Hospital: From a processing point of view in a hospital, the “case” is the container for the consolidation of all services provided for recording patient information, diagnosis and therapy (discussions, operations, therapies, care) and the resulting consumption (drugs, implants, medical consumables, accommodation, meals). The treatment pathway describes in detail the services to be provided and the items to be consumed. It thus corresponds to the work plan and the bill of materials in industry.

Public administration: “A product is created in public administration when a service is provided for an external customer (e.g., issuing of a passport, granting of a permit) or when new public assets are created by the service (e.g., construction of a district road) (see Rieder, Kosten-/ Leistungsrechnung für die Verwaltung, p. 66). Only when the product with its content and its scope of services has been defined can it be determined which internal administrative services are causally necessary for the creation and which purchases of materials and external services are to be provided. The quantity structure is documented in product-specific BOMs and work plans.

Bills of material and work plans are omnipresent. Management accounting takes the data for costing from the production planning and scheduling system (PPSS). It is here that the master data regarding input material, external services, process flows, machines, cost centers, standard times and planned purchase prices are maintained and the orders are planned and processed according to that data.

Please note: The use of the complete kitchen equipment was not included in the calculation of the pizza dough. The equipment must be available in an operational and efficient condition so that any products can be produced. If the kitchen is not used, electricity costs are still incurred for the operation of the refrigerator/freezer. The kitchen must be cleaned periodically so that it remains operational. It is also necessary that equipment such as cutlery, bowls, plates, cake trays, etc. be available. From a business point of view, the kitchen, whether used or not, loses value every day because it becomes outdated. This circumstance is taken into account through depreciation. All these cost elements are not caused by the meals produced, but by the decision as to how the kitchen should be equipped and maintained. They cannot be attributed to the manufactured product, i.e., the pizza dough, according to their cause and therefore do not appear in the calculation.

In accounting for management, only those costs are attributed to a product or service that are directly incurred by its creation. The corresponding proportional planned costs are also used to value the inflows and outflows of inventory, because in this way the inventories are always valued at standard costs and the variances are charged to the reporting period. Management accounting is used for internal planning and control. It can only provide orientation data for the calculation of the sales price.

The cost of the product and of the infrastructure tell the pizza baker if he can survive with the possible sales prices. The shrewd pizza baker determines his sales prices based on the sales prices of his competitors and his own estimate of the superiority of his offer. His cost is only of secondary importance.